Simplifying ICT New Week Opening Gap Strategy

The New Week Opening Gap (NWOG) is a crucial concept in trading, especially for those who follow the Inner Circle Trader (ICT) methodology. It refers to the price gap between the closing price on Friday and the opening price on Sunday.

This gap is predominantly observed in indices like the S&P 500 and is less frequent in forex pairs, except in cases of significant geopolitical or economic news.

What is NWOG in ICT trading?

The NWOG occurs between the close on Friday and the open on Sunday, reflecting a price discontinuity due to the weekend market closure. This gap is almost a weekly occurrence in indices due to the impact of news and market sentiment changes over the weekend.

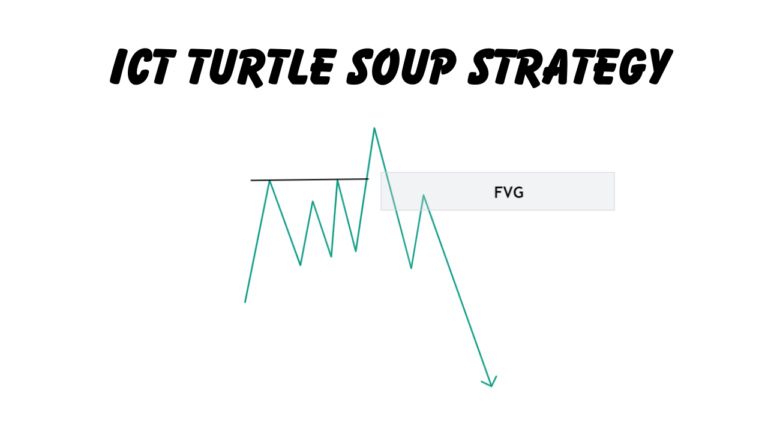

The NWOG acts as a strong magnet for price action, meaning prices often return to this level during the trading week. This makes the gap a critical area for traders to watch, as it can indicate potential reversals or continuations in price movement.

Traders should mark the NWOG on their charts every week and keep it visible throughout the trading week. This gap provides a valuable reference point for analyzing market movements and can be crucial for decision-making in trading strategies.

How the New Week Opening Gap (NWOG) is Formed?

The New Week Opening Gap (NWOG) happens because of the break in trading over the weekend and new information that comes out during this time. Here’s a simple explanation:

- Market Closure: Trading stops on Friday evening and starts again on Sunday evening.

- News and Events: Important news like economic reports, company earnings, or geopolitical events occur over the weekend.

- Market Reaction: When trading resumes, the market adjusts to this new information, causing the opening price on Sunday to be different from the closing price on Friday, creating a gap.

Examples

- Positive News: Good economic data or resolved conflicts can cause a gap up (higher opening price).

- Negative News: Bad economic data or new conflicts can cause a gap down (lower opening price).

Why It Matters

- Trading Opportunities: Traders watch for these gaps as potential points for buying or selling.

- Support and Resistance: The gap often acts as a level where prices might stop and reverse, making it a useful tool in trading strategies.

Key Points

- NWOGs are more common in indices and future contract like the S&P 500 and rare in forex pairs.

- Major events, especially geopolitical or economic, are primary causes.

- They offer insight into market sentiment and potential price movements for the week.