ICT Trading Strategy Book PDF

You are looking for the Inner Circle Trader aka ICT trading strategy. ICT trading strategy relies simply to follow the market maker footprints.

Key Component of ICT Strategy

What is ICT Liquidity?

Liquidity is the most important thing in this market. Many SMC traders really believe that they understand what liquidity is. In fact, they don’t understand it. Liquidity is what makes the market move, not of supply and demand. Rather, liquidity because this is a market that moves based on price manipulations and to be there Price manipulation in order to obtain liquidity.

What is the fair value gap in smart money concept?

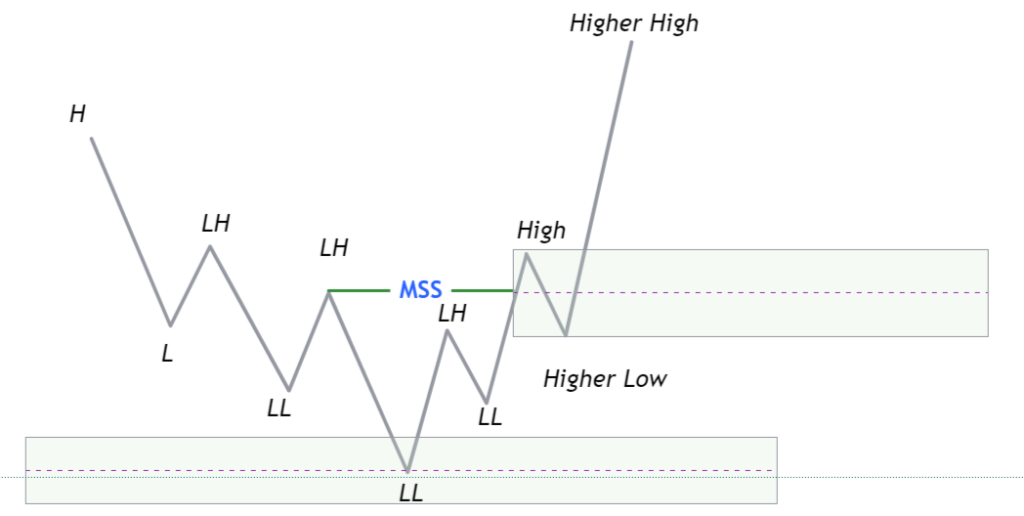

A Fair Value Gap (FVG) is a three-candlestick pattern where the body of the second candle is not filled by the wicks of the first and third candles. This gap represents a price imbalance, and the market often returns to fill it, providing traders with an opportunity to execute trades. First Confirmed Valid MSS then execute trades on the base of ICT FVG.

ICT Order Block Trading Strategy

Order Blocks are price levels where large institutions, often referred to as smart money, place bulk orders, moving the price in their desired direction. In ICT (Inner Circle Trader) terminology, Order Blocks signify a change in the state of price delivery.

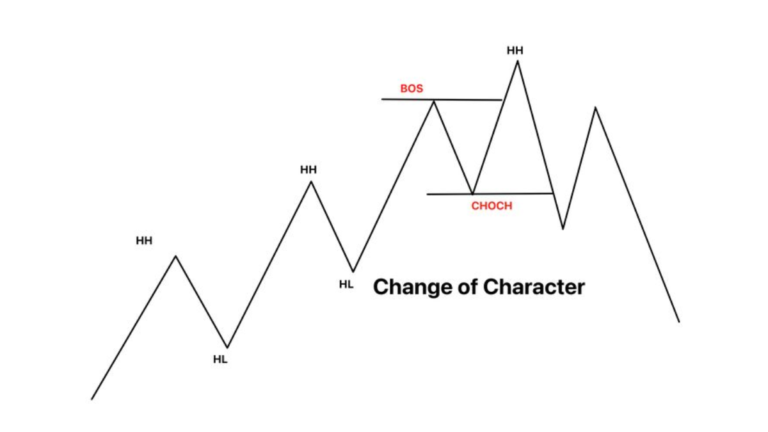

For example, if the market is in a downtrend, making lower lows and lower highs, it may reach a key price level that interests smart money.

At this level, the price may reverse direction from bearish to bullish, causing a Market Structure Shift with significant price movement. This change in price delivery is referred to as an Order Block in ICT trading.

On lower time frame price comeback to these order block and trader can execute their trades. Basically order block are the foot print of smart money. Retail traders follow these step of large hedge funds and bank and execute their trades.

Premium and Discount (PD Arrays)

In ICT (Inner Circle Trader) trading, Premium and Discount Zones help traders find the best points to buy or sell based on price levels.

What are Premium Zone:

- This zone is above the 50% level on a Fibonacci retracement of a price move.

- It is generally considered a good area to sell.

- Avoid buying in this zone because prices are seen as too high.

What Are Discount Zone:

- This zone is below the 50% level on a Fibonacci retracement of a price move.

- It is considered a good area to buy.

- Prices in this zone are seen as low or at a discount.

These zones help traders align their entries with market trends and price action.

On recent leg place fib the level above from the 50 of fib consider premium zone and not consider buying in that zones. Similarly level below the 50% of Fib zones are consider discount zones and never find

What time are the ICT kill zones?

In ICT (Inner Circle Trader) trading, Kill Zones are specific time periods during the trading day when market activity and volatility are higher, providing better trading opportunities. The main ICT Kill Zones are London, New York and London Close Kill Zones.

Learn more about

Complete ICT Trading Strategy Forex (2022 Mentorship Model)

- Select Pairs to Trade: Focus on major pairs. My preferences are EURUSD and GBPUSD.

- Trade During Kill Zones: Ensure your trades are executed within the designated kill zones for optimal volatility.

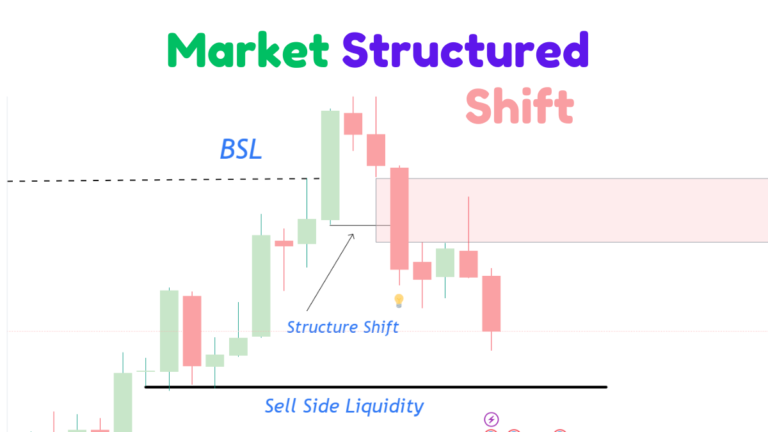

- Wait for Liquidity Sweep: On the 15-minute time frame, wait for a liquidity sweep.

- Monitor for Market Structure Shift (MSS): After the liquidity sweep, look for a Market Structure Shift on the 5-minute time frame.

- Identify Fair Value Gap (FVG): Once the MSS is confirmed, find the Fair Value Gap on the 1-minute and 3-minute time frames.

- Execute Trades: Execute your trades in the direction of your daily bias.

Click on the below button for downloading inner circle trading strategy book in pdf format.

Helping Traders Scale to $10k/month in EUR/USD, GBP/USD, and E-mini S&P

With over 7 years of Forex market experience, Osama Asif is an expert in technical and fundamental analysis. Since 2024, he has been a key contributor to the ICT Trading platform. As a Certified Financial Risk Manager (FRM), Osama is passionate about precision and dedicated to guiding traders to achieve their financial goals in the Forex market.