ICT Drawn On Liquidity (DOL)

In the world of trading, understanding where price is likely to move next can give you a significant edge. One of the most powerful concepts that can help you predict these movements is Draw on Liquidity (DOL). In simple terms, ICT DOL refers to the price being attracted to areas with a significant concentration of orders, known as liquidity pools. These pools act as magnets, drawing the price towards them as institutions and large traders aim to trigger these orders.

In this blog post, we’ll dive deep into the concept of Draw on Liquidity, explaining what it is, how to identify it on your charts, and most importantly, how to trade it effectively. By the end, you’ll have a clearer understanding of how to anticipate price movements and make more informed trading decisions.

What is ICT Draw on Liquidity?

Draw on Liquidity refers to the natural tendency of price to move towards areas where there is a high concentration of orders. These areas, known as liquidity pools, include stop-loss clusters, order blocks, fair value gaps, and significant highs and lows.

Large market participants, such as institutions, target these areas to fill their orders with minimal slippage, causing the price to gravitate towards these points.

where to find liquidity

Identifying Draw on Liquidity is all about spotting the areas on the chart where price is likely to be drawn.

- Previous Week High/Low (PWH/PWL): These are critical levels where price often reacts. Institutions may target these levels to trigger stop-loss orders placed by retail traders.

- Previous Day High/Low (PDH/PDL): Similar to weekly levels, these daily highs and lows are frequently targeted as they represent recent liquidity pools.

- Session High/Low (Asia, London, New York): Each trading session creates its own highs and lows, which can serve as short-term liquidity targets. Monitoring these levels helps in understanding where the price might be drawn during different market hours.

- Equal Highs/Equal Lows (EQH/EQL): These are levels where the price has touched multiple times without breaking through, creating a pool of liquidity. These areas are particularly attractive to institutions looking to trigger retail stops.

- Low Resistance Liquidity Run (LRLR): This condition occurs when the price moves quickly through a level with little resistance, often towards an EQH or EQL. It’s a sign that liquidity is being targeted.

How to Find Next DOL?

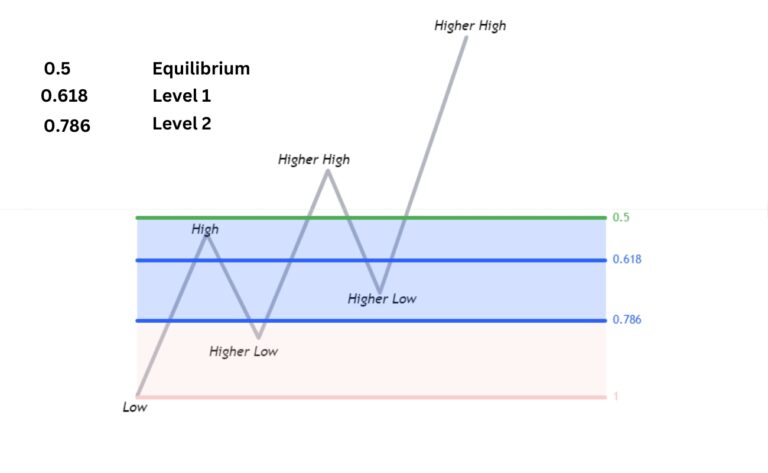

Price is always engaged in one of two actions: rebalancing or taking liquidity. Understanding this fundamental concept is crucial for anticipating market movements. The price moves from one Premium/Discount (P/D) array to another, seeking out areas of imbalance or liquidity.

To effectively track these movements, it’s essential to annotate your P/D zones. This helps you determine whether the price has already rebalanced or if it’s likely to do so in the near future. Additionally, marking key liquidity levels on your chart will provide a clearer picture of potential targets.

When trying to identify the next Draw on Liquidity, look for a displacement in the price action. This sharp move often signals that liquidity has been taken. Then, observe how the price reacts when it reaches a P/D array, as this reaction can indicate the next direction the price is likely to move.

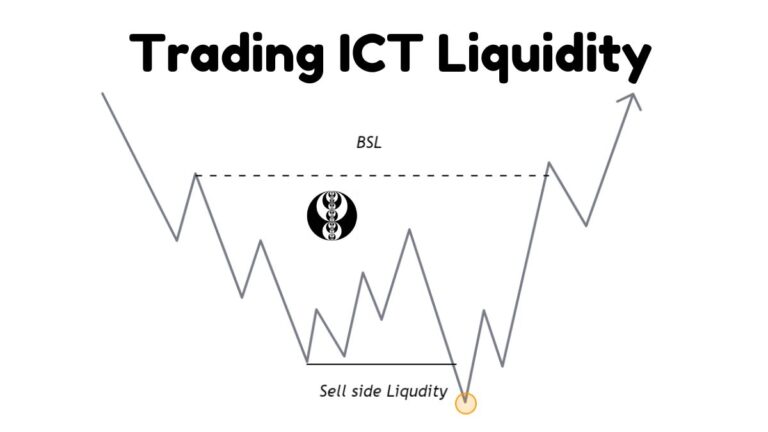

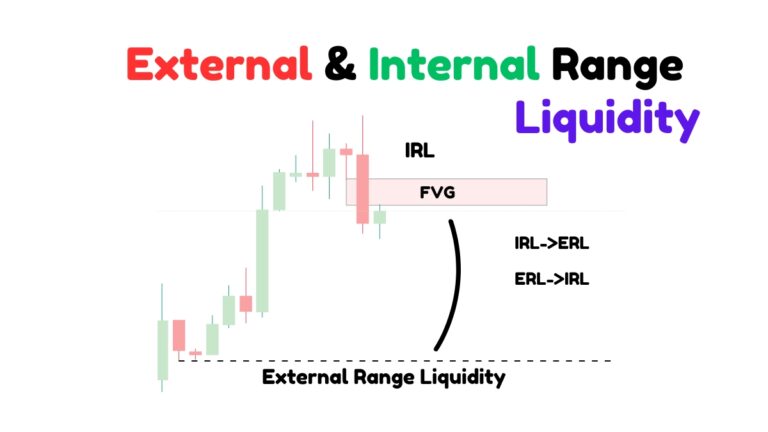

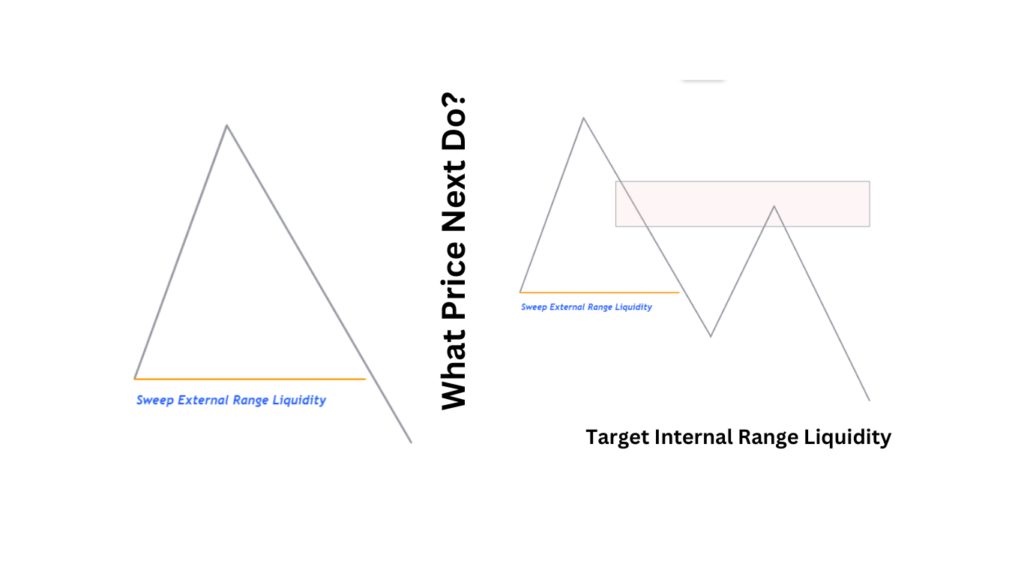

In the diagram above, we have an example of External Range Liquidity, represented by an old low. After the price moves up, it begins to drop repeatedly, eventually taking out that old low. This is a classic case of External Range Liquidity being targeted.

Remember, price typically engages in one of two activities: moving towards old highs or lows to take out liquidity, or seeking to rebalance by filling imbalances such as Fair Value Gaps (FVGs).

In this scenario, after the price took out the External Range Liquidity, the next logical step is for the price to draw towards an internal liquidity target, such as an FVG. When an old high or low gets raided, it’s important to look for an imbalance within that range where the price might seek to rebalance. Once that internal liquidity gets tapped, the price may then move towards the next external liquidity point, continuing the cycle.

Here’s a refined version of your text:

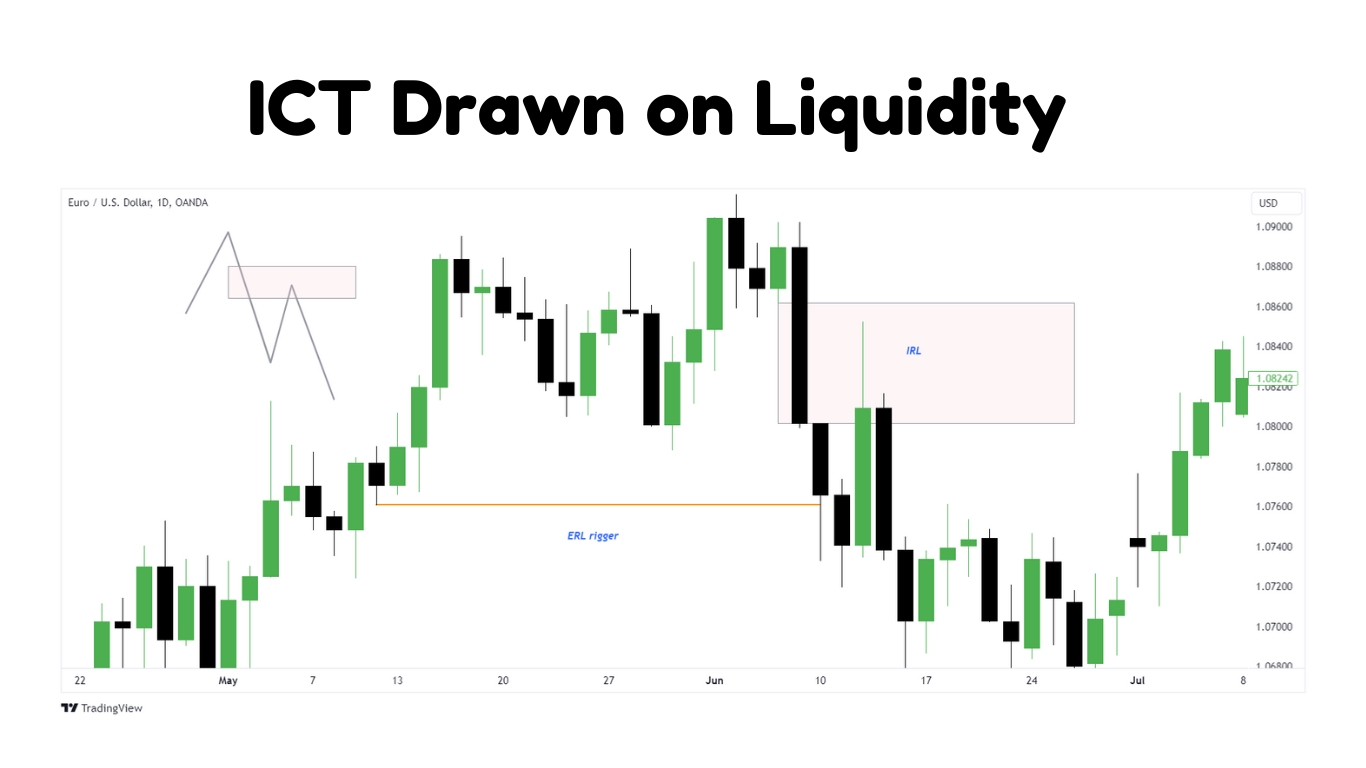

The EUR/USD chart above is a classic example of Draw on Liquidity (DOL) on the daily time frame. The price first takes out the external range liquidity (ERL) at the 1.07584 level. After capturing this ERL, the price moves upward to rebalance the imbalance between the 1.08602 and 1.08019 levels. Following this rebalancing, the next target for the price is the ERL located at the 1.08019 level.