ICT Breaker Block Trading Strategy: Example and Explanation

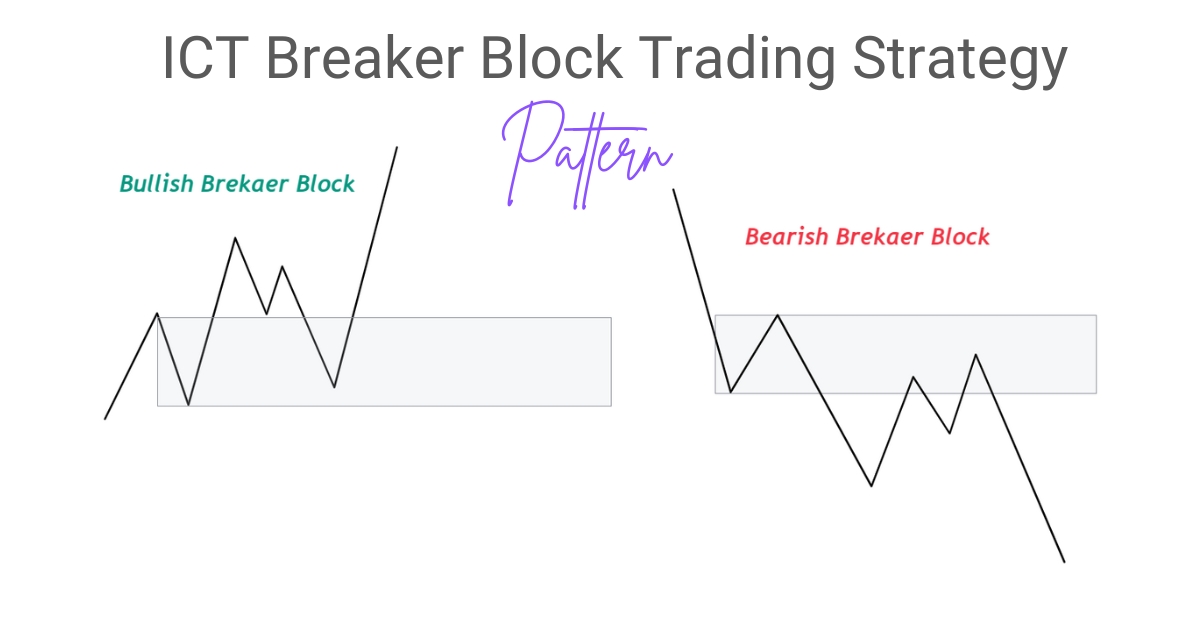

A Breaker Block is a type of Order Block (OB) that gets broken by a strong, sudden price movement without any pullback. For a Breaker Block to form, the market must break the last high or low, depending on the trend.

The main purpose of a Breaker Block is to create price movement through manipulation, gathering liquidity near key highs or lows, followed by a breakout in the opposite direction. This often leads to a trading setup known as a Stop Hunt, where the price is manipulated to trigger buy-stop or sell-stop orders.

How the Breaker Block Works

The Breaker Block operates similarly to an Order Block, but it only reacts after a strong, sudden price move. After a Stop Hunt has manipulated liquidity and changed the trend, large capital often pushes the price back to the Breaker Block zone for a retest, to close out unprofitable positions after the manipulation.

To understand a Breaker Block better, it’s essential to analyze impulse candles on the chart. For instance, if you see that a Bullish or Bearish OB has been broken, taking liquidity from a high or low, it may signal a potential trend reversal, known as a Breaker Block.

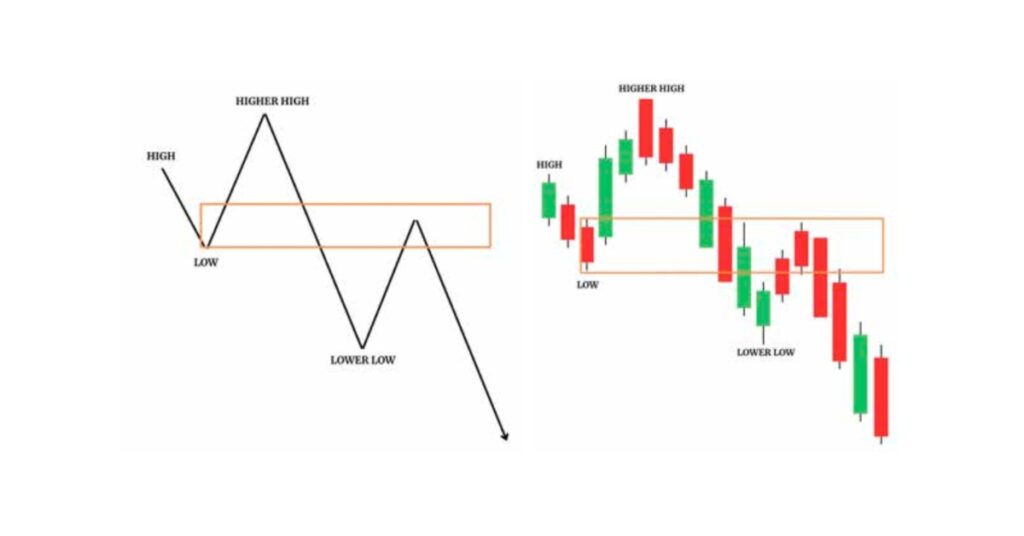

However, despite its name, a Breaker Block in trading is not always a reversal pattern. It can also indicate the continuation of a trend. To determine the market trend, look for the formation of higher highs (HH) and higher lows (HL) for a bullish trend, and lower lows (LL) and lower highs (LH) for a bearish trend. A Breaker Block forms after a new HH or LL is created during an impulse breakout of an Order Block.

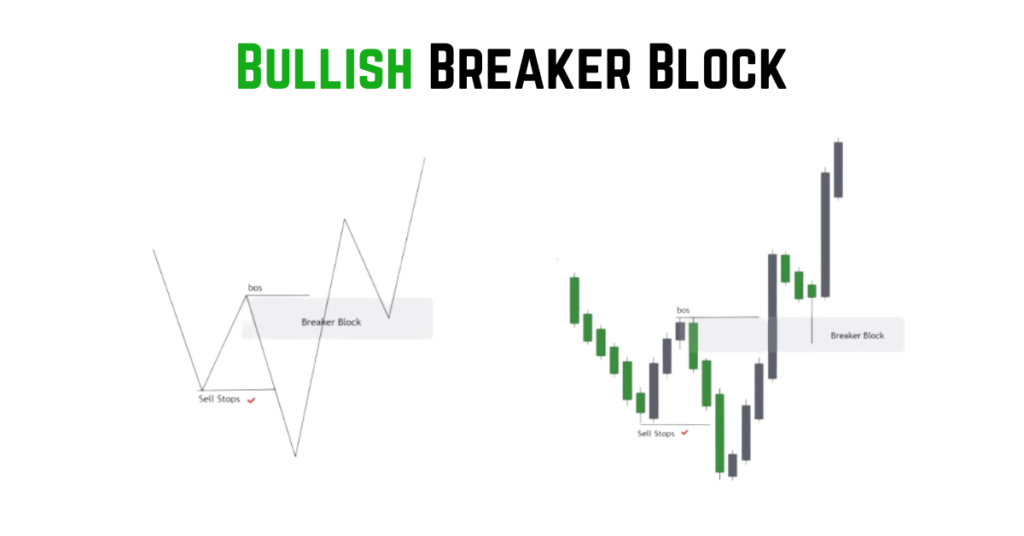

How a Bullish Breaker Block Forms

Before a Bullish Breaker can form, liquidity must be taken. To change the market trend direction, an impulsive move downward is required, followed by a strong move that grabs liquidity from the HL level to continue the uptrend. After the price shifts direction, an impulsive breakout of the OB should be expected.

When Bearish OB failed its become bullish breaker block

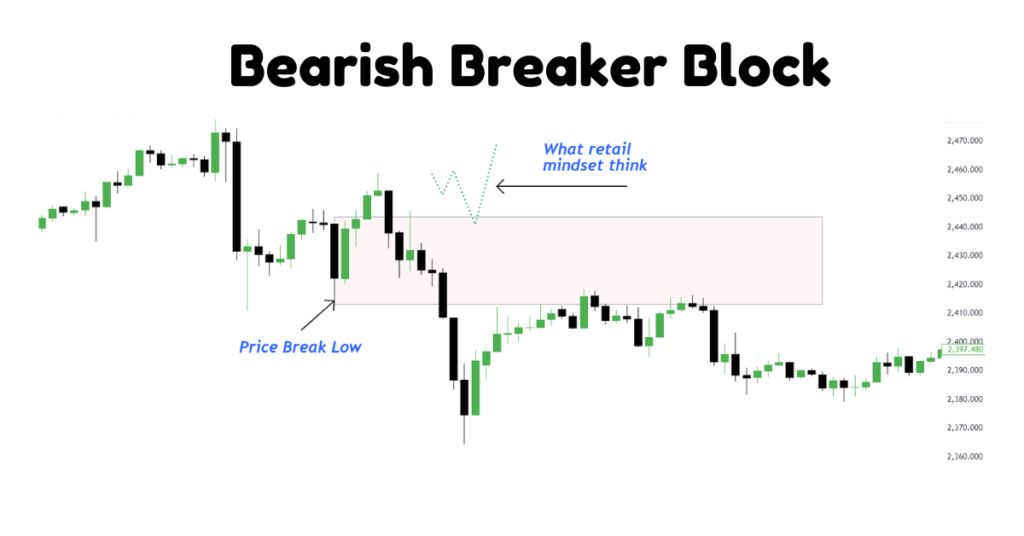

How a Bearish Breaker Block Forms

Before a Bearish Breaker forms, liquidity must be taken from the previous trend element. If the trend is down, the momentum occurs at the LH level. If the trend is changing from rising to falling, the momentum occurs at the HH level. To confirm a bearish breaker, wait for a change in price direction and an impulsive breakout of the Order Block.

When Bullish OB failed its become bearish breaker block.

Examples of Breaker Block Pattern

The chart above illustrates a Bearish Breaker Block on the GOLD/USD pair. The price aggressively sweeps liquidity below the Bullish Order Block, causing it to transform into a Bearish Breaker Block.

Things to Remember

- Higher High (HH): In a bullish scenario, when the price closes above the HH, it suggests a strong upward move.

- Lower Low (LL): In a bearish scenario, when the price closes below the LL, it indicates a strong downward move.

- Order Block (OB): A Breaker Block is essentially an OB that has been broken by a powerful impulse without a pullback.

- Liquidity Zones: These are areas that smart money often targets, especially if they are pronounced and go against the main trend.

By observing the high and low points of a range, and analyzing the gradients within it, traders can determine potential entry and exit points using the Breaker Block strategy.