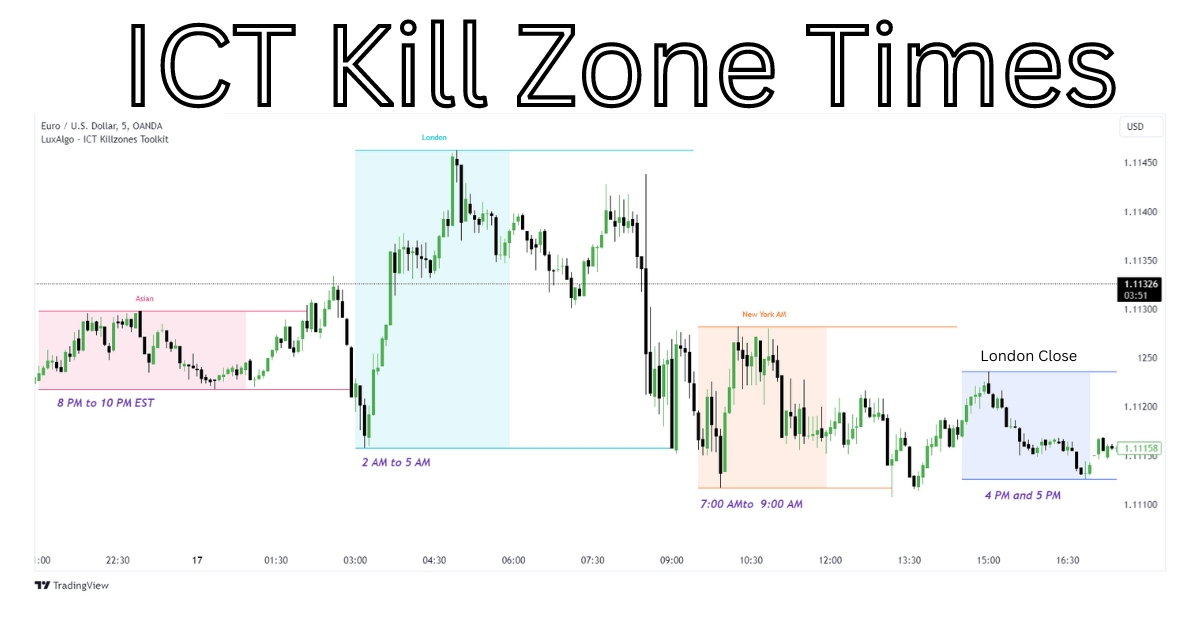

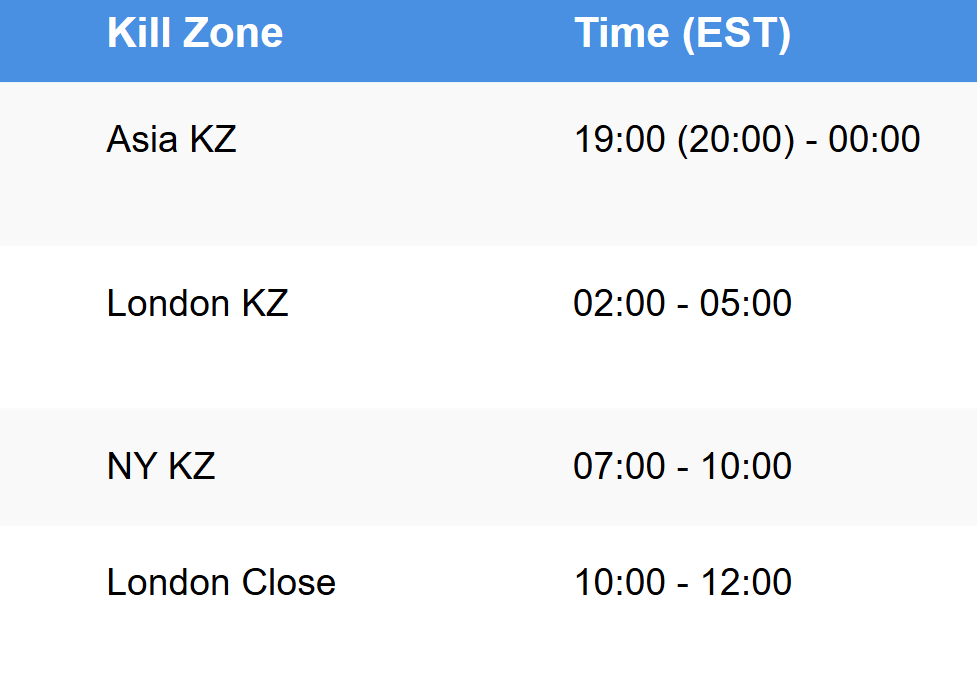

ICT Kill Zone Times (Asia, London, New York): Best Time for Forex Trading

ICT Kill Zones are strategic time windows during key trading sessions—Asia, London, New York, and the London Close—where high-probability setups frequently emerge. These ICT Kill Zone Times mark the best time for Forex trading, offering traders opportunities to enter positions with favorable risk-to-reward ratios. The increase in volatility during these sessions allows for quick scalping, often yielding 30 to 40 pips in a short timeframe.

Understanding the ICT Kill Zone is essential for mastering the Forex market hours. By focusing on the two core components of the ICT strategy—Time and Price—traders can significantly improve their accuracy and profitability, making the most of these critical periods.

What are ICT Kill Zones Times?

ICT Kill Zones are specific time frames in the Forex market identified by Inner Circle Trading (ICT) as periods of increased volatility and trading volume. These times are strategically significant for traders looking to capitalize on high-probability trading setups.

What are Key Attribute of Kill Zone Times

- Increased Volatility: Kill Zones represent specific times when market volatility surges, providing traders with opportunities for significant price movements.

- High Trading Volume: These periods coincide with major financial market openings and closings, leading to increased trading volume and liquidity, which can result in tighter spreads.

- Optimal Trade Setups: Traders can identify high-probability trading setups during Kill Zones, as these times are often characterized by clear price action patterns and trends.

- Economic Data Releases: Many important economic announcements occur during these times, further amplifying market movements and creating additional trading opportunities.

Asian Kill Zone

The ICT Asian Kill Zone is an important time for Forex traders, particularly those focused on pairs like the New Zealand Dollar (NZD), Japanese Yen (JPY), and Australian Dollar (AUD). This period, which spans from 8 PM to 10 PM EST, offers unique trading opportunities for scalping.

Key Characteristics

- Currency Pairs to Focus On: The NZD, JPY, and AUD pairs are ideal during this session, offering low-risk, high-probability trades.

- Optimal Trade Entry (OTE) Patterns: The Asian Kill Zone time often sets up OTE setups that can offer 15-20 pip scalps.

- Scalping Opportunities: Scalpers can take advantage of short-term retracements, whether the market is trending bullish or bearish.

- Consolidation Patterns: Consolidation patterns during this time often form the daily range, making it a key reference point for trades throughout the day.

Asian Killzone Times in GMT UTC and EST

| Time Zone | Asian Kill Zone Start | Asian Kill Zone End |

|---|---|---|

| EST | 8:00 PM | 10:00 PM |

| GMT | 1:00 AM | 3:00 AM |

| UTC | 1:00 AM | 3:00 AM |

London Kill Zone

The London Forex Kill Zone, occurring from 2 AM to 5 AM New York Local Time, is a prime trading period in the Forex market. Its high liquidity and volatility make it a hotspot for capturing significant price movements. Overlapping with both the Asian and New York sessions, it’s particularly attractive to traders focusing on major currency pairs like GBP/USD, EUR/USD, and GBP/JPY.

London Kill Zone Complete Trading Strategy

Key Characteristics of London Session

- High Liquidity and Volatility: The London Kill Zone starts the European trading session, increasing market activity, particularly in GBP and EUR pairs.

- Optimal Trade Entry (OTE) Patterns: The heightened volatility creates numerous OTE setups, offering traders opportunities to capitalize on strong price movements.

- Currency Pairs to Focus On: Key pairs to trade include GBP/USD, EUR/USD, GBP/JPY, and EUR/GBP, as they experience larger price swings during this session.

- Overlap with Other Sessions: The London Kill Zone overlaps with the Asian session’s closing and the New York session’s opening, making it ideal for price reversals or breakouts.

- Increased Volatility During News Releases: Major European or UK economic news (e.g., interest rates, GDP reports) often coincides with this session, amplifying volatility.

- Scalping and Swing Trading: The large intraday price movements make this session suitable for both scalping and swing trading strategies.

London Killzone Time GMT,EST and UCT

| Time Zone | London Kill Zone Start | London Kill Zone End |

|---|---|---|

| EST | 2:00 AM | 5:00 AM |

| GMT | 7:00 AM | 10:00 AM |

| UTC | 7:00 AM | 10:00 AM |

The above table shows the time frames for the London Kill Zone, enabling traders to adjust their trading plans and capture key market movements during this high-volume period.

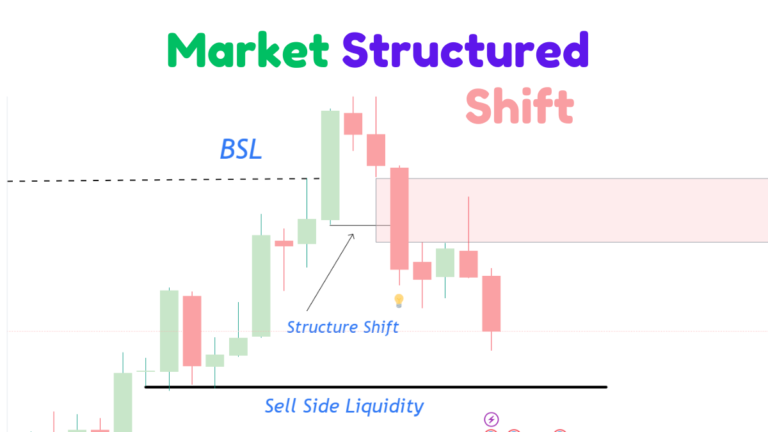

The chart illustrates a trading opportunity at the start of the London session. Initially, the price swept through the liquidity at the low of the Asian session. On the 1-minute timeframe, we observed a market structure shift, which created a Fair Value Gap (FVG). This shift indicates a potential trading opportunity, with the next target being the equal high, as marked by the red line on the chart.

What is ICT New York Kill Zone

The New York Kill Zone is a specific trading period in the Forex market that’s known for its high volatility and trading activity. It starts at 7:00 AM and ends at 9:00 AM New York Local Time. This kill zone is best time to trade major currency pair coupled with dollar . Like EURUSD,GBUSD,XAUUSD. The NYK session open frequently from Optimal trade setup for the quick scalp of 20-30 pips.

Why is it important?

- High Volatility: Prices can move up or down quickly during this time.

- Trading Opportunities: There are often good chances to buy or sell currencies.

- Market Opening: It’s when the New York Stock Exchange opens, which can influence the Forex market.

NY Kill Zone Times in GMT,EST and UTC

Here’s a table showing the New York Kill Zone Times in GMT, EST, and UTC:

| Time Zone | Start Time | End Time |

|---|---|---|

| GMT | 12:00 PM | 2:00 PM |

| EST | 7:00 AM | 9:00 AM |

| UTC | 12:00 PM | 2:00 PM |

This table displays the New York Kill Zone Times converted into different time zones .

ICT London Close Kill Zone

The London Close Kill Zone is a period of high volatility in the Forex market that typically occurs around the London Stock Exchange’s closing time, which is usually between 4 PM and 5 PM GMT. During this time, traders often see significant price movements as investors unwind their positions and adjust their portfolios.

Key characteristics of the London Close Kill Zone:

- High volatility: Prices can fluctuate rapidly due to increased trading activity.

- Increased risk: The potential for both gains and losses is higher.

- Trading opportunities: Some traders find this period to be profitable, but it requires careful analysis and risk management.

London Close Killzone Time GMT,EST,UTC

Below table to show the London Close Killzone Times in GMT, EST, and UTC:

| Time Zone | London Close Killzone Time |

|---|---|

| GMT | 16:00 – 16:30 |

| EST | 11:00 – 11:30 |

| UTC | 16:00 – 16:30 |

ICT Forex Kill Zones Time Chart

How to Mark ICT Killzones on Trading View Platforms

- Manual Marking: You can manually draw vertical lines or shaded boxes on your trading charts to represent these times. Ensure your chart is set to New York time to align with these periods accurately.

- Using Indicators: Many traders utilize custom indicators available on platforms like TradingView that automatically highlight these killzones on your charts. You can search for terms like “ICT Killzones” or specific indicators such as “LuxAlgo ICT Kill Zone” to find tools that suit your needs

Can ICT Killzones be used for swing trading or day trading

ICT Kill Zones are primarily used for finding intraday trading opportunities. However, swing traders can also plan their trade executions based on these specific time frame windows to align their trades with key market levels due to increase in market volatility and liquidity.

What are the best pairs to trade during the ICT New York Kill Zone.

During the ICT New York Kill Zone, which runs from 7:00 AM to 10:00 AM EST, traders typically focus on major currency pairs that involve the US dollar due to the increased volatility and liquidity during this period. The best pairs to trade during this time include: EURUSD,GBPUSD,JPYUSD,XAUUSD,BTCUSD.

How does the overlap between the London and New York sessions affect trading.

The overlap between the London and New York trading sessions, which happens from 8:00 AM to 12:00 PM EST, has a big impact on forex trading. During this time, both markets are open, leading to higher trading volumes and smoother transactions with tighter spreads.

This makes it easier for traders to buy and sell quickly. The overlap also brings more price movement, or volatility, which can create chances for profit, especially if important economic news comes out. Traders often focus on major currency pairs like EUR/USD, GBP/USD, and USD/JPY during this period because these pairs see the most action and price changes due to the increased market activity.

Helping Traders Scale to $10k/month in EUR/USD, GBP/USD, and E-mini S&P

With over 7 years of Forex market experience, Osama Asif is an expert in technical and fundamental analysis. Since 2024, he has been a key contributor to the ICT Trading platform. As a Certified Financial Risk Manager (FRM), Osama is passionate about precision and dedicated to guiding traders to achieve their financial goals in the Forex market.