What is Change of Character in Trading

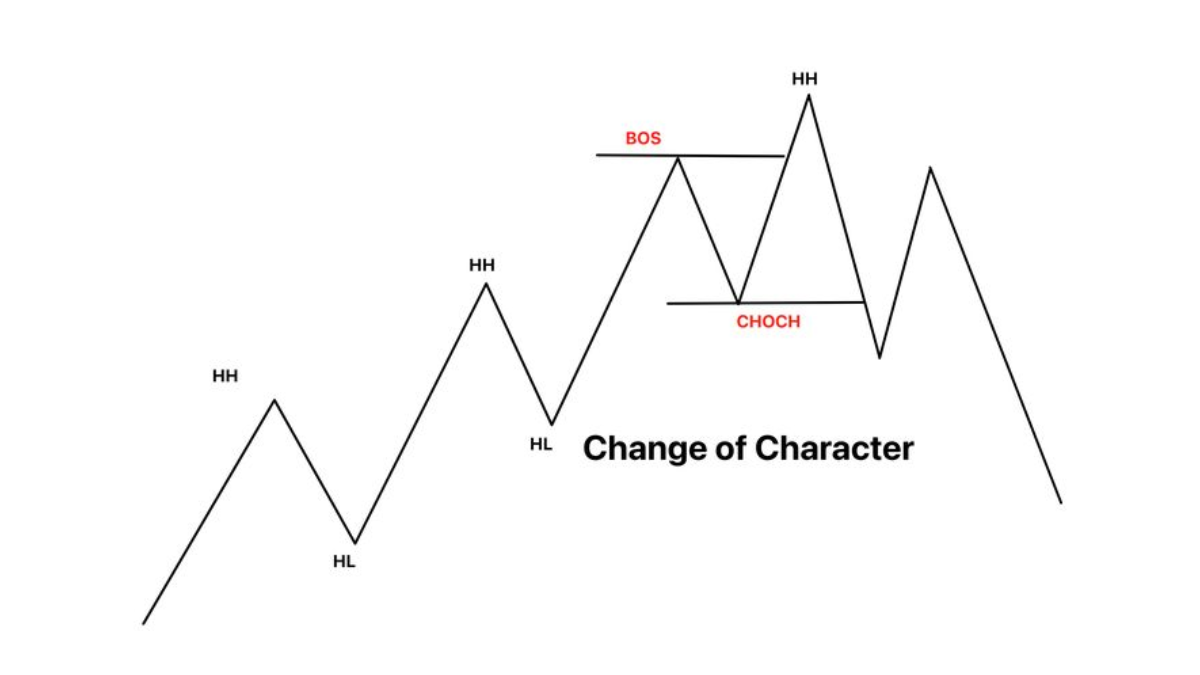

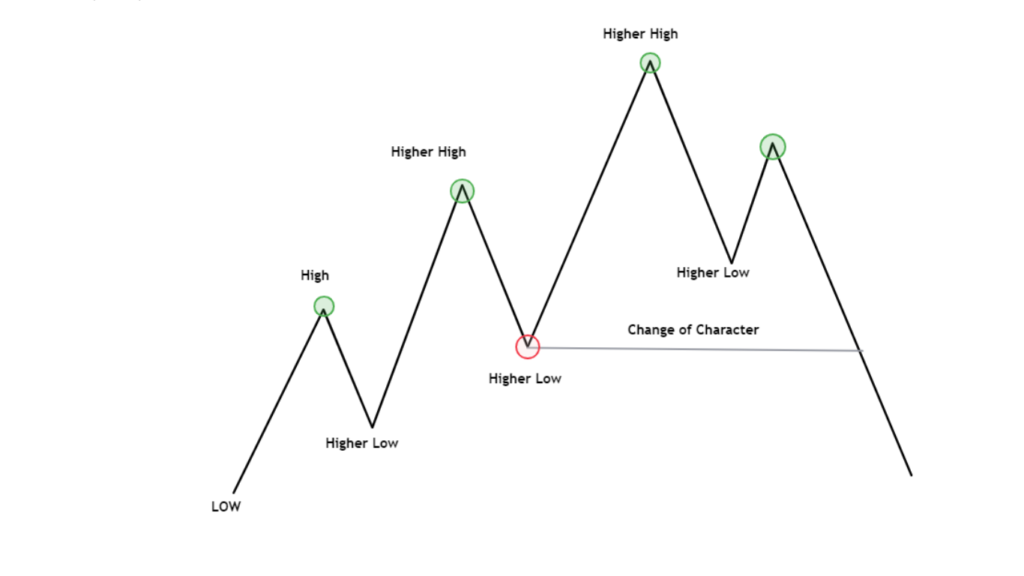

When the market shifts its sentiment from bullish to bearish and bearish to bullish, we observe a change of character. For instance, if the market is in a downtrend, making lower lows and lower highs, and then reaches a higher time frame Point of Interest (POI), it may reverse direction.

This reversal is often characterized by an aggressive price movement that breaks the recent swing high or lower high.

Similarly, in the case of an uptrend, the market might be making higher highs and higher lows. Upon reaching a higher time frame POI, it may change direction and break the recent swing low or higher low.

What does a change of character mean?

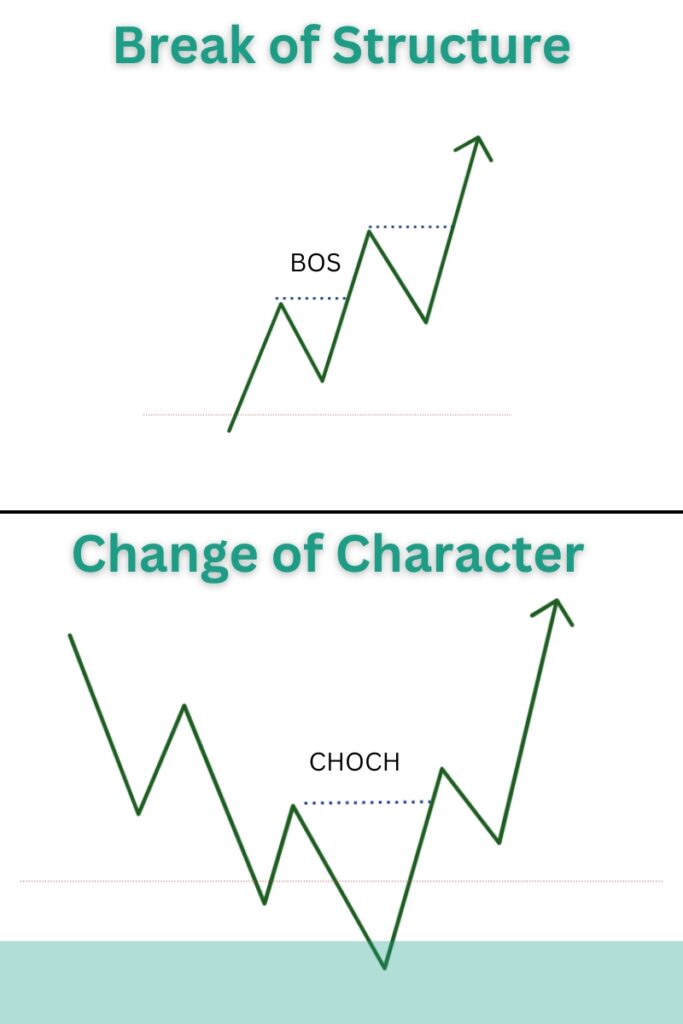

Change of Character (CHOCH) refers to a shift in the market’s order flow. It indicates the end of the current trend and the beginning of a new one. Recognizing CHOCH helps traders identify new trading opportunities and plan their trades accordingly.

How to Find Valid CHOCH in Forex Trading

To identify a valid Change of Character (CHOCH), wait for the price action to break at least two higher lows when the market sentiment shifts from bullish to bearish, break of lower high when market change its direction from bearish to bullish.

Higher time frame confluence adds more weight to the validity of the market structure shift. Once the CHOCH is confirmed on higher time frames such as H1 or H4, move to lower time frames to find trading opportunities.

Trading Strategy

Start by analyzing the desired trading instrument chart, such as EUR/USD or GBP/USD, on higher time frames. Begin with the Weekly and Daily time frames to identify the order flow.

The chart above shows the change in character (CHOCH) on the EUR/USD weekly time frame. The second CHOCH confirms that EUR/USD sentiment has shifted from bearish to bullish.

The next step is to draw points of interest (POIs) that align with the weekly or daily order flow. It is crucial to avoid trading against the daily and weekly order flow.

The third step is to wait for the price to return to these points of interest. Once it does, switch to a lower time frame to identify entry points.

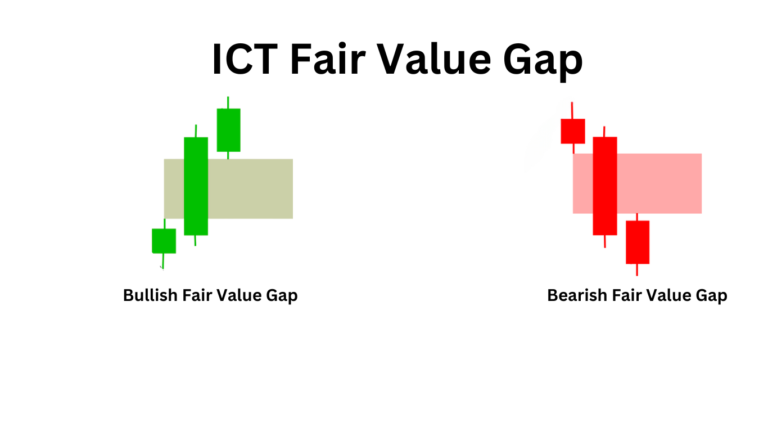

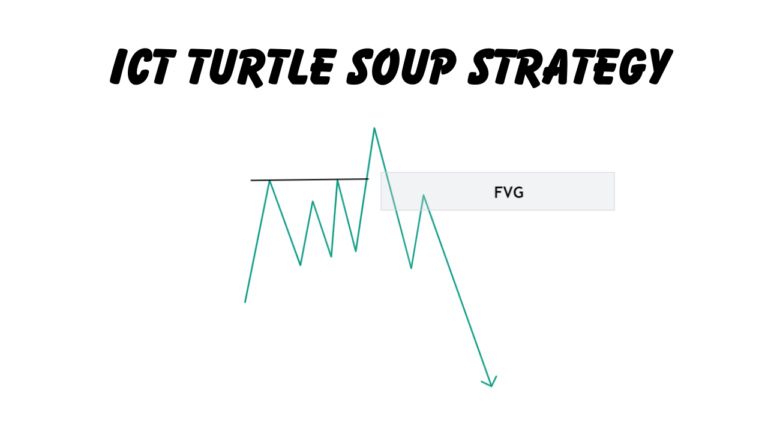

Look for a market structure shift on the lower time frame and identify price imbalances or ICT fair value gaps (FVG) on the 1-minute time frame. Execute your entries and set your take profit at the next liquidity level.

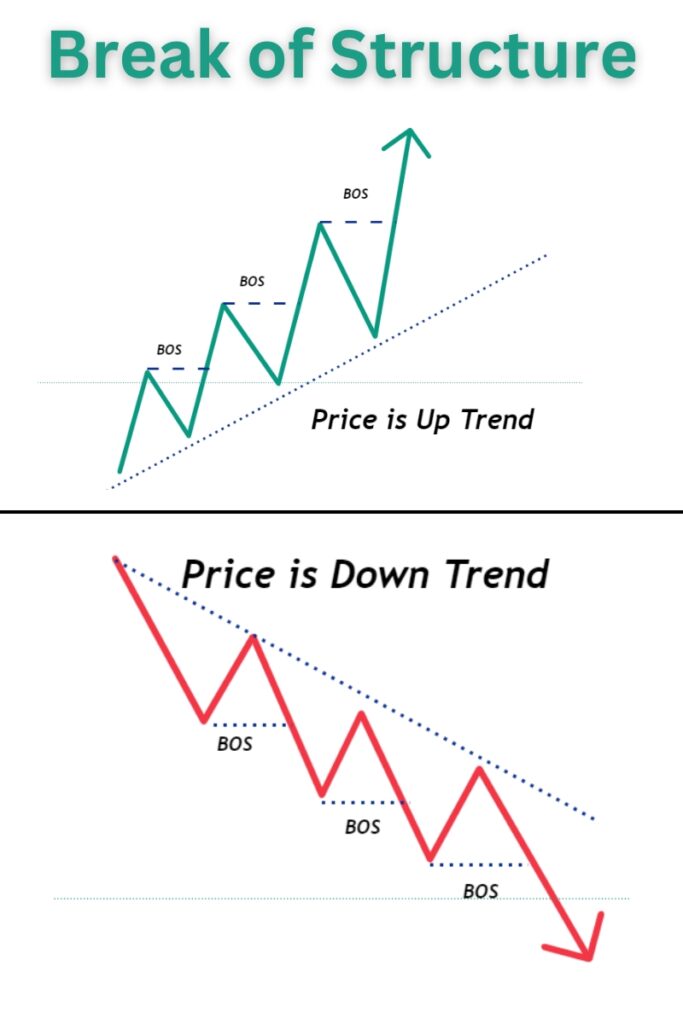

What is Break of Structure in Forex Trading

A Break of Structure (BOS) occurs when the price breaks the most recent high or low point in a trending market. In an uptrend, the price forms higher highs and higher lows. When the market creates a new higher high that surpasses the previous higher high point, this is known as a Break of Structure (BOS).

what is the difference between bos and choch?

Here’s a table comparing Break of Structure (BOS) and Change of Character (CHOCH):

| Aspect | Break of Structure (BOS) | Change of Character (CHOCH) |

|---|---|---|

| Definition | Occurs when the price breaks the recent higher high in an uptrend or the recent lower low in a downtrend. | Occurs when the market breaks a swing high or low in the opposite direction of the current trend. |

| Indication | Indicates market continuation. | Indicates a shift in market sentiment from bullish to bearish or vice versa. |

| Trend Direction | Continues in the direction of the current trend (uptrend or downtrend). | Signals a potential reversal in the current trend. |

| Trade Execution | Trades can be executed when the price retraces in the direction of the trend. | Trades can be executed in the opposite direction of the trend. |

| Market Signal | Confirms the strength and continuation of the existing trend. | Helps in identifying the early stages of a new trend. |

| Example in Uptrend | Price makes a new higher high above the previous higher high. | Market breaks a swing low, indicating a potential bearish reversal. |

| Example in Downtrend | Price makes a new lower low below the previous lower low. | Market breaks a swing high, indicating a potential bullish reversal. |

How to find valid cHOCH?

To find a valid Change of Character (CHOCH), it is essential to analyze higher time frames. Start by examining the weekly and daily time frames to identify the overall market trend. Then, look for CHOCH on the H4 and H1 time frames.

The validity of a CHOCH is higher when a higher time frame Point of Interest (POI) is present. When the price reaches this POI and changes direction, wait for the break of two lower highs to anticipate the price movement from bearish to bullish.

Helping Traders Scale to $10k/month in EUR/USD, GBP/USD, and E-mini S&P

With over 7 years of Forex market experience, Osama Asif is an expert in technical and fundamental analysis. Since 2024, he has been a key contributor to the ICT Trading platform. As a Certified Financial Risk Manager (FRM), Osama is passionate about precision and dedicated to guiding traders to achieve their financial goals in the Forex market.