ICT Breaker Block: Complete Trading Strategy

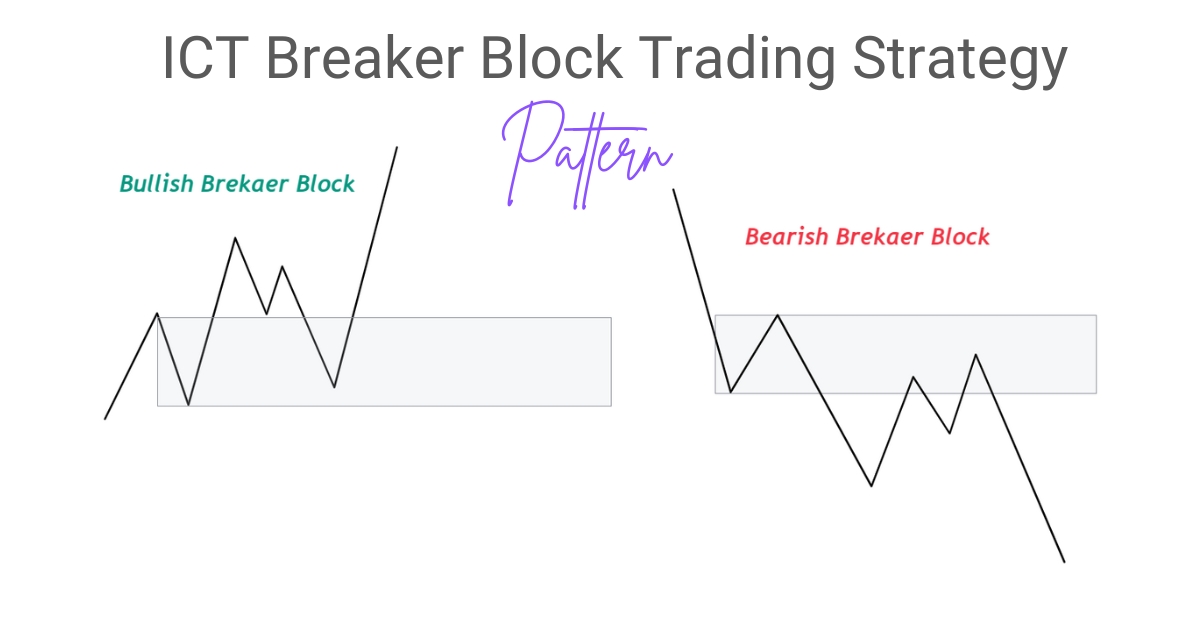

Inner Circle Trader (ICT) breaker blocks refer to failed order blocks. An order block becomes a breaker block when it does not hold its expected support or resistance level, effectively “breaking” its initial purpose. Traders use these ICT breaker blocks as reference points for planning their market entries, as they can signal potential shifts in market momentum or direction.

You have landed on the right page if you want to learn about Inner Circle Trader (ICT) breaker blocks. This introduction will guide you through breaker blocks, how they form, and how traders utilize them to make informed trading decisions.

What is ICT Breaker Block

ICT breaker blocks, as defined by Michael J. Huddleston, also known as the Inner Circle Trader (ICT), are failed order blocks that occur when price action sweeps the liquidity of an order block.

- A failed bullish order block transforms into a bearish breaker block when price fails to hold above the bullish order block and sweeps its liquidity.

- Conversely, a failed bearish order block becomes a bullish breaker block when price fails to sustain below the bearish order block and clears its liquidity.

Traders leverage these breaker blocks as strategic points for planning entries and exits, as they often highlight areas of significant liquidity manipulation and market intent.

How To Identified and Trade Breaker Block

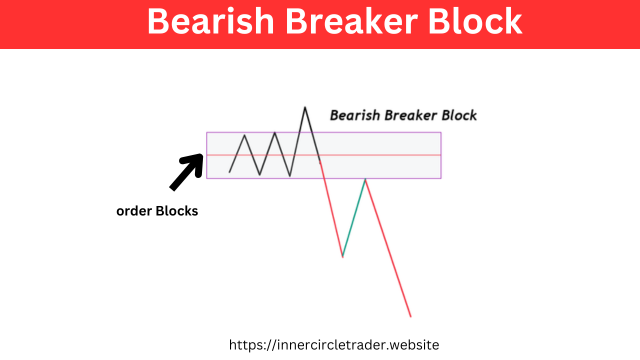

The first step is to locate failed order blocks on the chart. These blocks represent areas where the expected support or resistance provided by an order block is invalidated, with price breaking through and sweeping its liquidity. Once identified, these failed order blocks should be marked as potential breaker block zones. These zones become the foundation for analyzing future price action.

Once a breaker block is identified, patience is crucial. Allow the price to move away and then return to the marked zone. During the retest, the breaker block often acts as either a support or resistance level, depending on its type.

As the price approaches the breaker block, switch to lower timeframes, such as 1-minute or 3-minute charts, to closely observe price behavior.

The final and most important step is to wait for a market structure shift (MSS). This occurs when the price shows an aggressive change in direction or momentum around the breaker block zone. The MSS serves as confirmation that the breaker block is valid and is being respected by the market. Without this confirmation, the validity of the breaker block remains uncertain.