Understanding ICT Enigma Trading Strategy

If you’re familiar with the world of trading, you’ve probably come across the name “Inner Circle Trader” or ICT. Michael J. Huddleston, the man behind ICT, has developed various strategies to help traders understand how the markets move, and one of the biggest mysteries he’s hinted at is something called “Enigma.”

In this post, I’ll break down what the Enigma is all about and how it ties into concepts like Internal Range Liquidity (IRL) and External Range Liquidity (ERL).

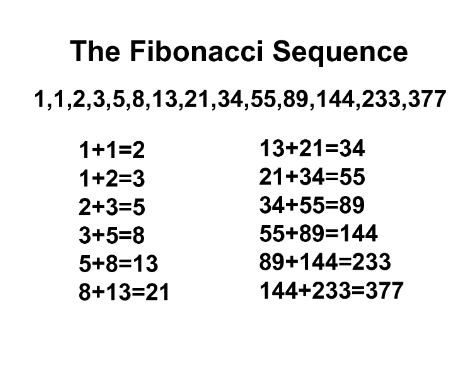

The Enigma is something Michael has been teasing for a while, and many traders are curious to crack its code. It’s often connected to how the market moves based on Fibonacci sequences—a series of numbers that repeat in a specific pattern.

You might already know about Fibonacci numbers like 1, 2, 3, 5, 8, and so on. When you compare any two Fibonacci numbers, you often get the ratio 0.618, which is also called the Golden Ratio. Michael suggests that there’s a hidden pattern in these numbers that helps him predict market movements with great accuracy. His logo, for instance, contains hidden Fibonacci sequences, and he’s using that as the foundation for his strategy.

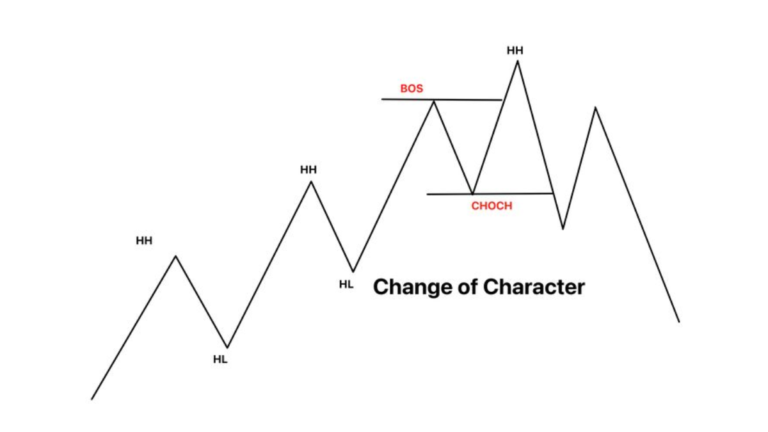

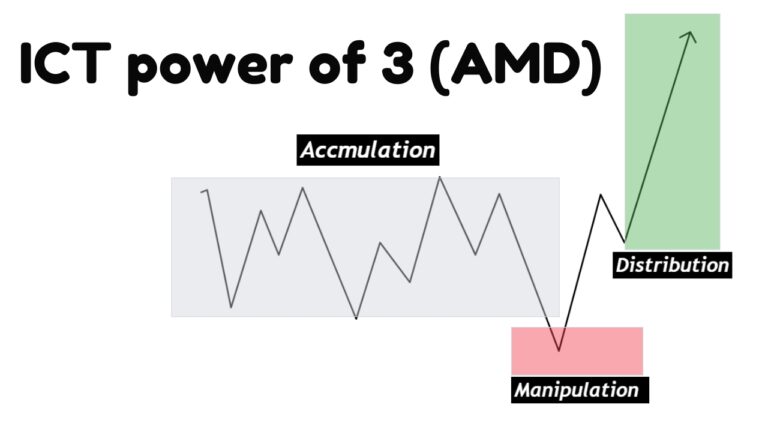

At its core, the Enigma is all about finding patterns in the Fibonacci numbers that repeat over time. For example, the sequence 2-1-2 could represent a repeated pattern that we see in the market. This 2-1-2 pattern might suggest how price moves up, retraces slightly, and then moves up again.

By using these patterns, we can identify potential retracement points or reversals, where the price might slow down or change direction.

The Enigma helps traders anticipate market movements by using Fibonacci sequences and fractal patterns (repeated shapes or structures). With these patterns, you can better understand where the price is likely to go and where it might reverse.

For instance, using the 2-1-2 sequence in price movements might help you spot a 50% retracement. Similarly, larger patterns like 5-3-5 might give you a 62% retracement, another critical level in trading.

ICT Enigma Integration With IRL and ERL

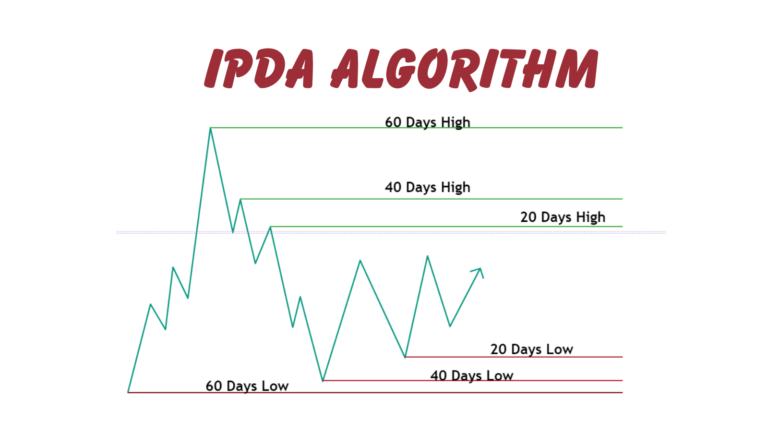

Internal Range Liquidity (IRL) refers to the liquidity found within a specific trading range. Think of it as the area inside the high and low of a recent price move. Traders use IRL to identify price action within that range, like areas where buyers or sellers might enter to push the price up or down.

External Range Liquidity (ERL) focuses on the liquidity outside of the recent price range, usually around the extremes of price (the highs and lows). When price breaks out of a range, it’s often going for the liquidity lying just beyond those key levels. Traders look to ERL to find potential areas for breakout trades or reversals.

Learn more about IRL and ERL.

Using Enigma with IRL: The Fibonacci sequences can help you identify retracements within the current trading range. If you know the sequence, you can anticipate where the price might pull back inside the range, giving you an edge when trading IRL.

Using Enigma with ERL: When price approaches the external range, the Fibonacci patterns can give you clues on whether the price will break through or reverse. You can use these insights to trade breakouts or liquidity grabs when the price seeks ERL.

- Understand Fibonacci Sequences: Know the common Fibonacci numbers and how they relate to market movements. Numbers like 0.618 (or 61.8%) are crucial for spotting potential retracements and reversals.

- Spot Repeating Patterns: Look for repeating patterns in price movements like the 2-1-2 or 5-3-5. These can help you predict where the price will go next, both within the internal range (IRL) and external range (ERL).

- Practice with Fractals: Fractals are repeating patterns at different timeframes. Once you recognize a pattern, zoom in or out on the chart to see how it repeats. This can help you understand market maker models and spot liquidity targets.

The Enigma, combined with IRL and ERL, gives traders a powerful tool for navigating the markets. By understanding Fibonacci sequences, fractals, and liquidity ranges, you can anticipate market movements with greater accuracy and confidence. Keep practicing, stay curious, and you might just crack the Enigma yourself!