Mastering ICT Judas Swing Strategy

When it comes to trading, finding a strategy with a high win rate can be challenging. If you are struggling with consistency in your trading, the Judas Swing strategy might be just what you need.

What Is ICT Judas Swing?

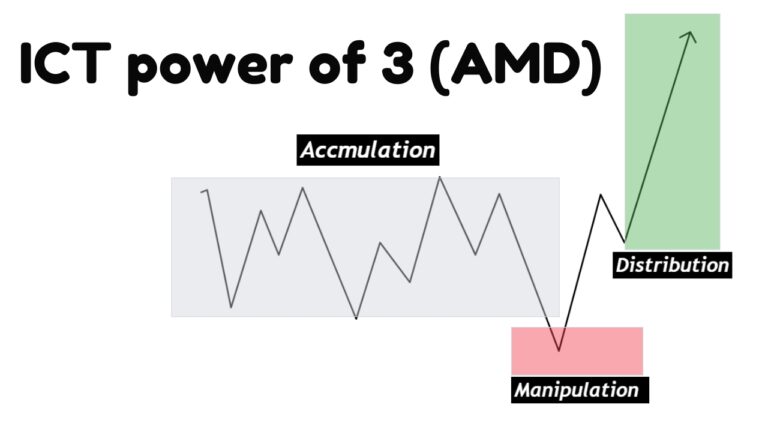

The Judas Swing is a tactic used by smart money to exploit retail traders who lack an understanding of higher time frame direction. This movement typically occurs from midnight New York local time to 5 AM New York local time.

Judas Swing Strategy Explained

To effectively use the Judas Swing strategy, follow these steps:

- Identify the Opening: Mark the opening of the New York midnight session, which starts at 12 AM, indicating the beginning of the new trading day.

- Mark Highs and Lows: Identify and mark the high and low points of the Asian session.

- Monitor the London Session: As the London session begins, watch for a sweep of liquidity from either the buy side or the sell side.

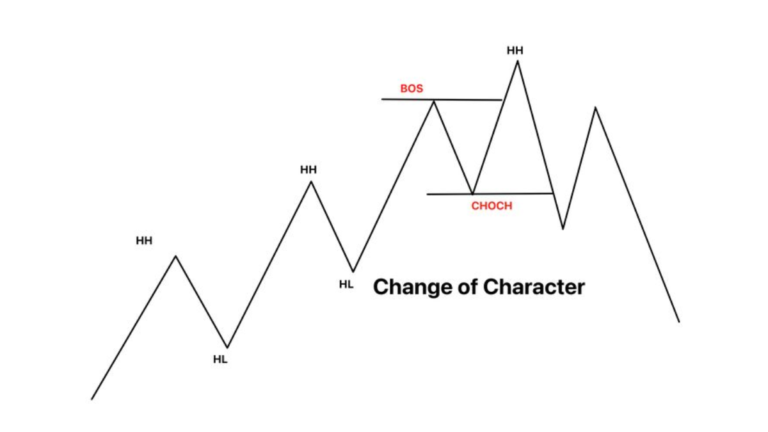

- Confirm Liquidity Sweep: Once a liquidity sweep is confirmed, wait for a market structure shift (MSS) with displacement, which is characterized by a strong price movement in the opposite direction of the liquidity sweep.

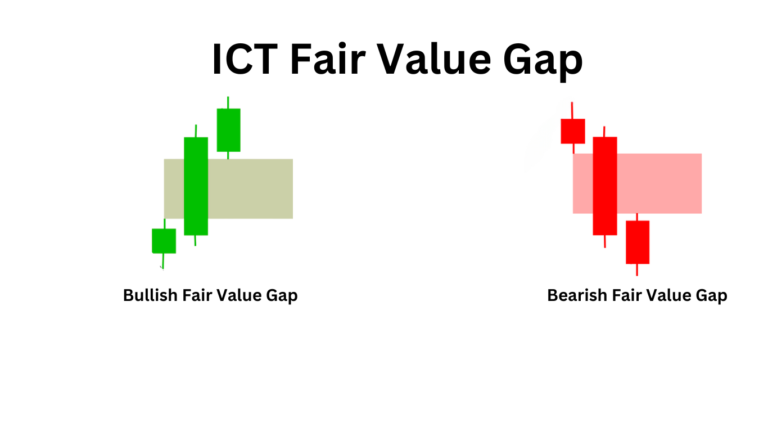

- Identify Entry Points: After confirming the MSS with displacement, switch to a 3-minute or 1-minute time frame. Wait for the price to return to an institutional reference point, such as a Fair Value Gap (FVG), an Order Block, or a Breaker Block.

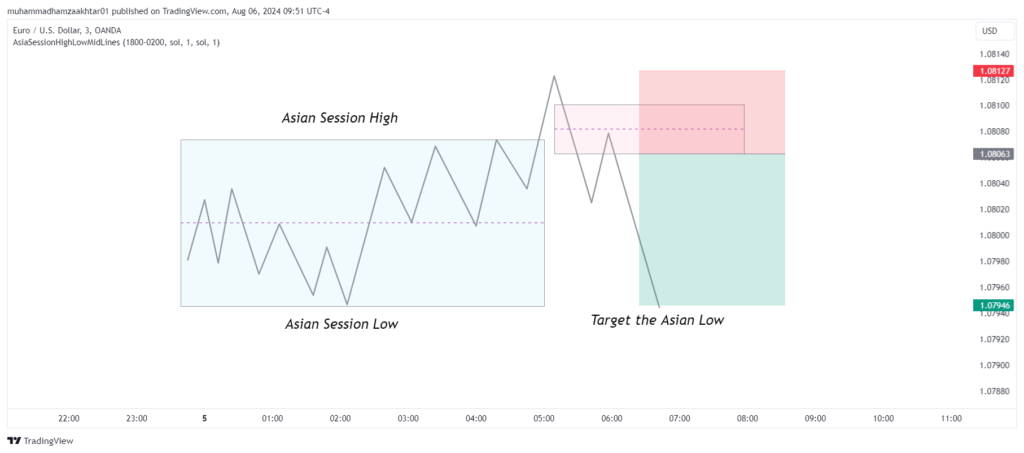

The chart above illustrates the ICT Judas Swing in a bearish scenario

Trading in Bearish Scenario

Midnight Opening: The price is trading above the New York midnight opening price, which is a key reference point for this strategy.

London Session Begins: As the London session starts, smart money sweeps liquidity from the buy side, creating a trap for retail traders who are positioned long.

Market Structure Shift (MSS): Following the liquidity sweep, a Market Structure Shift (MSS) occurs. This is characterized by a significant and energetic price movement in the opposite direction, indicating a change in market sentiment.

Fair Value Gap (FVG): This price movement leaves behind a Fair Value Gap (FVG), which is an imbalance that the market will likely fill.

Filling the Price Imbalance: As the market fills this price imbalance, traders should look for entry points. Ideal targets for these trades are the Asian session low or any bullish Daily Price Action (DPA) arrays located at the Asian session low.

Trading in Bullish Scenario

When anticipating a bullish day, wait for a liquidity sweep on the sell side at the start of the London session. Look for a market structure shift that leaves a gap behind, typically a fair value gap. As this gap fills, you can target the Asian high or another significant level, such as an old or equal high, as your take-profit point.

From above EURUSD chart it is clear that

Sell-Side Liquidity Sweep: Around 1.09050 (Asian Low)

Entry Point: Around 1.09100 (3-minute IFVG)

Take-Profit (TP) Point: Around 1.09450 (Asian High)

What time does the Judas Swing occur?

The ICT Judas Swing begins at midnight New York local time and ends at 5 AM New York local time. This is the exact timeframe Michael J. Huddleston (ICT) describes in his videos.

What is the pattern of a Judas swing?

The ICT Judas Swing follows a simple pattern.

- Bearish Trend: Wait for a liquidity purge from the buy side. Then, look for a market structure shift (MSS) that leaves a fair value gap (FVG) or any institutional reference point behind it. Target the sell-side liquidity.

- Bullish Trend: Wait for a liquidity hunt on the sell side. Then, observe a market structure shift (MSS) that leaves a fair value gap (FVG) or any institutional reference point behind it. Target the buy-side liquidity or the Asian Session High.

What is the win rate of the ICT Judas swing?

The win rate depends on the instrument or market conditions you trade and your understanding of market fundamentals and higher time frames. As I back tested the EURUSD pair, it yielded a roughly 73.5% win rate, which is considered quite good.

What is the meaning of a Judas swing?

In trading, a “Judas swing” refers to a price movement that initially misleads traders into believing a trend is forming in one direction, only to reverse sharply and move in the opposite direction. This term is often associated with deceptive market behavior designed to trap traders who might enter trades based on the false signal.

The name comes from the biblical figure Judas Iscariot, who betrayed Jesus, symbolizing betrayal or deception. In trading, it underscores the idea of the market betraying traders by moving against their expectations after an initial misleading signal.

Download Trading Forex Strategy PDF

For downloading Judas ICT Swing Trading Strategy in PDF format click on the below download button.

Helping Traders Scale to $10k/month in EUR/USD, GBP/USD, and E-mini S&P

With over 7 years of Forex market experience, Osama Asif is an expert in technical and fundamental analysis. Since 2024, he has been a key contributor to the ICT Trading platform. As a Certified Financial Risk Manager (FRM), Osama is passionate about precision and dedicated to guiding traders to achieve their financial goals in the Forex market.