ICT Macro Time Simplifying the Time Based Strategy

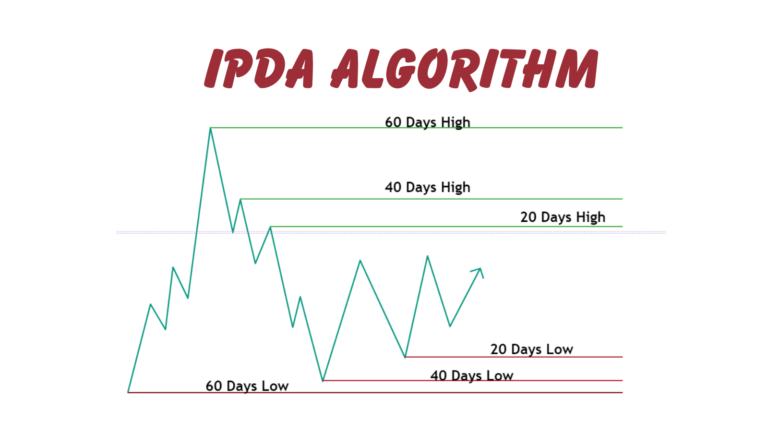

ICT (Inner Circle Trader) Macro is a time-based strategy that focuses on when the trading algorithm is more active towards liquidity sweeps. This typically happens when the IPDA (Interbank Price Delivery Algorithm) is most active during the trading day.

Time and price are two critical components when trading with the ICT strategy. It’s a common myth that one can find equal trading opportunities 24 hours a day, five days a week. For day traders, it’s crucial to understand the specific ICT macro times when high-probability trading setups are more likely to form. In this blog post, we’ll explore these key periods and how to leverage them for more effective trading.

What Is ICT Macro Times?

ICT Macro times are specific periods when trading algorithms significantly increase their activity to target and manipulate liquidity. During these intervals, the Interbank Price Delivery Algorithm (IPDA) aggressively sweeps up existing liquidity and engineers new liquidity traps to deceive retail traders.

What is ICT London macro time?

ICT London Macro Times are crucial trading periods during the early hours of the London trading session, where high-probability setups often form. If you can’t monitor the entire London session, focusing on these specific time slots can help you identify valuable trading opportunities.

The first London Macro time interval runs from 2:33 AM to 3:00 AM EST, and the second interval spans from 4:03 AM to 4:30 AM EST. These intervals are key for capturing initial market movements and trends, which can significantly influence the trading activity for the rest of the day

The following table outlines the start and end times of the two London Macro hour windows in both Eastern Standard Time (EST) and Greenwich Mean Time (GMT).

| London Macro Time Interval | EST | GMT |

|---|---|---|

| First Interval | 2:33 AM – 3:00 AM | 7:33 AM – 8:00 AM |

| Second Interval | 4:03 AM – 4:30 AM | 9:03 AM – 9:30 AM |

London Macros time Trading strategy

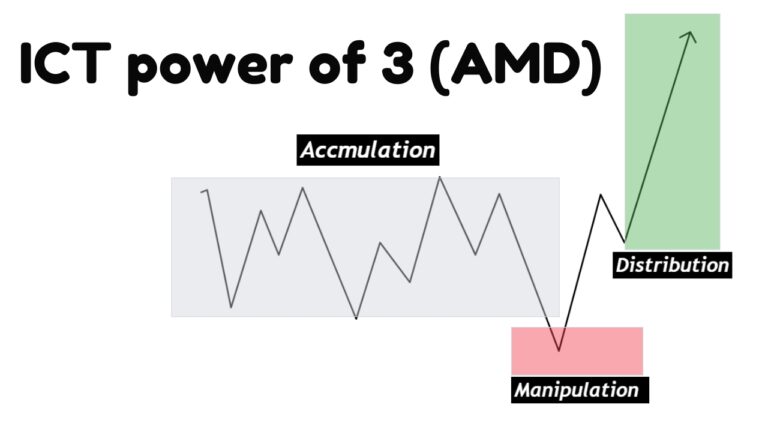

For trading during the London Macros, you can apply the ICT Power of 3 trading strategy.

- Opening of Macro Time (2:33,4:03 AM EST): At the beginning of the macro time interval, start by observing the market for the initial accumulation phase. This is where the market begins to gather or accumulate orders, setting the stage for future price movements.

- Manipulation Phase: After the accumulation phase, watch for signs of market manipulation. Manipulation occurs when the market moves in a way designed to mislead traders and induce them to enter positions that the market makers want to exploit. Look for sharp, sudden price movements or false breakouts as indicators of manipulation.

- Market Structure Shift: Following the manipulation phase, monitor the market for a shift in market structure. A market structure shift indicates a change in the direction or momentum of the market. Learning how to identify valid market structure shifts is crucial, as this will signal potential entry points for your trades.

- Target Liquidity: Once you identify a market structure shift, focus on targeting liquidity in the distribution phase. This involves looking for areas where the market is likely to provide liquidity, such as key support or resistance levels. Depending on the shift, target either internal liquidity (within the current range) or external liquidity (outside the current range). This strategy is applied on the 1-minute time frame to capture short-term trading opportunities.

- Alternative Strategy – Liquidity Hunt: Another approach is to wait for a liquidity hunt, where the market seeks out and captures liquidity by moving through existing orders. After identifying this liquidity hunt, analyze the premium and discount array to determine the best direction for your trades. This involves understanding how the market is priced relative to its historical values and making trades in the direction opposite to the liquidity sweep.

- Confirmation with Daily Bias: For more secure trading, ensure that your trades align with your overall daily bias and higher time frame analysis. This means that your trade setups should be consistent with the broader market trend or bias you’ve identified for the day and supported by higher time frame charts. This confirmation helps increase the reliability of your trades and reduces the risk of adverse movements.

By following these steps, you can effectively use the ICT Power of 3 strategy during the London Macro times to enhance your trading decisions.

What is ICT New York AM Macro Times?

The New York AM Macros sessions focus on the morning trading activities in the New York market. The first session runs from 9:50 AM to 10:10 AM EST, and the second macros time interval start at 10:50 AM and ends at 11:10 AM EST.

These periods are essential for observing how the market reacts to early economic data releases and news, providing potential trading opportunities.

| Session | Macro Open (EST) | Macro Close (EST) | Macro Open (GMT) | Macro Close (GMT) | Description |

|---|---|---|---|---|---|

| First Session | 9:50 AM | 10:10 AM | 2:50 PM | 3:10 PM | The first New York AM Macros session focuses on morning trading activities, capturing market reactions to early economic data releases and news, which may provide trading opportunities. |

| Second Session | 10:50 AM | 11:10 AM | 3:50 PM | 4:10 PM | The second New York AM Macros session continues to observe market behavior and trends in response to ongoing economic updates and news, offering further trading opportunities. |

What time is the NY PM Macro?

The New York PM Macro sessions are scheduled as follows:

- First Macro: 1:10 PM to 1:40 PM EST

- Second Macro: 3:15 PM to 3:45 PM EST

The table below showing the New York PM Macro sessions in both EST and GMT:

| Session | Macro Open (EST) | Macro Close (EST) | Macro Open (GMT) | Macro Close (GMT) |

|---|---|---|---|---|

| First Macro | 1:10 PM | 1:40 PM | 6:10 PM | 6:40 PM |

| Second Macro | 3:15 PM | 3:45 PM | 8:15 PM | 8:45 PM |

NY Lunch Macro

The NY Lunch Macro session captures the trading activity during the New York lunch hour, running from 11:50 AM to 12:10 PM EST. This period may be quieter compared to other sessions but can still present trading opportunities as traders position themselves for the afternoon session.

| Event | Time (EST) | Time (GMT) |

|---|---|---|

| Macro Open | 11:50 AM | 4:50 PM |

| Macro Close | 12:10 PM | 5:10 PM |

What is the Time of ICT Last Macro Hour?

Last Macro Hour Time start from 5PM New York Local time to 6 PM NY Local time.

ICT Macro Complete Step by Step Trading Strategy

During macro hours, the algorithm seeks and destroys liquidity. To trade effectively during these times, follow these steps:

- Select the macro time you want to trade.

- Before the opening of the selected macro time, mark the liquidity levels on a 15-minute time frame chart.

- Wait for the algorithm to sweep the liquidity during the macro period.

- Trade in the direction of the macro trend after the liquidity sweep.

This is the ICT quick scalp strategy for trading macro times.

For example, if the algorithm takes sell-side liquidity during the London Open Macro and a Market Structure Shift (MSS) occurs on the 5-minute time frame, you can enter the trade by targeting the next buy-side liquidity.

It’s important to note that having a higher time frame bias is crucial for successful trading.

Does ICT Macros work with cryptocurrency or digital assets?

Yes, the macros strategy works in forex, indices, and digital currencies. The chart below (BTC1!) is a Bitcoin futures chart and demonstrates a trading setup formed at the opening of the London macro.

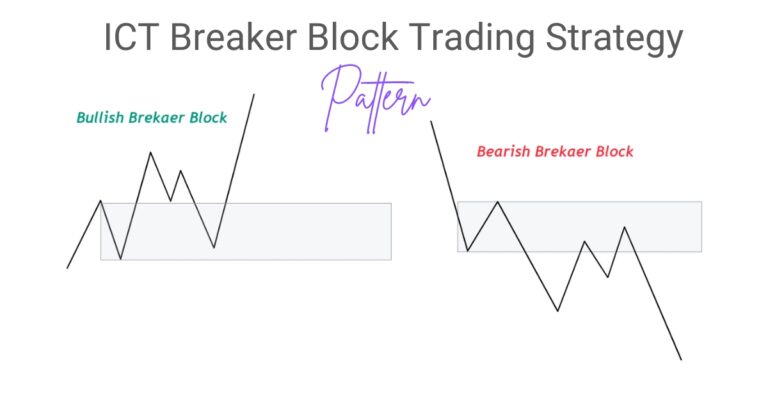

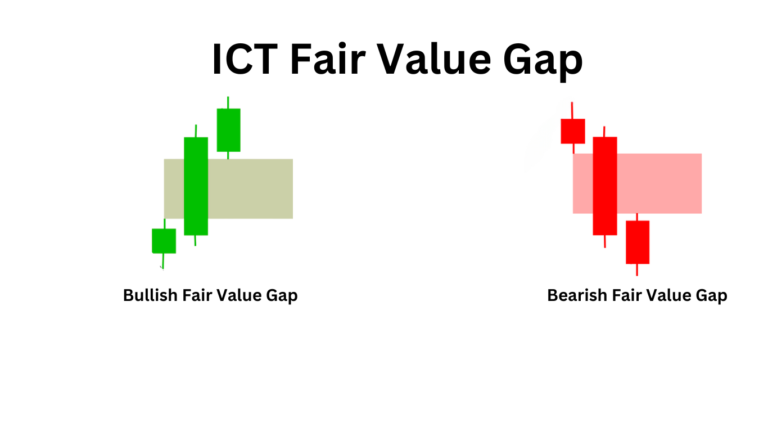

The price delivery algorithm first sweeps buy-side liquidity, creating a new high. Then, a Market Structure Shift (MSS) occurs on the 3-minute time frame. This MSS leaves a Fair Value Gap (FVG), which the price retraces to fill before moving down to target the next liquidity level.

It’s important to note that it is not necessary for the price to sweep the next liquidity level within the same macro period. Your trade can extend beyond the macro time, but the trading setup is eventually formed.

Consider another example of EURUSD pair and how Macro work.

Helping Traders Scale to $10k/month in EUR/USD, GBP/USD, and E-mini S&P

With over 7 years of Forex market experience, Osama Asif is an expert in technical and fundamental analysis. Since 2024, he has been a key contributor to the ICT Trading platform. As a Certified Financial Risk Manager (FRM), Osama is passionate about precision and dedicated to guiding traders to achieve their financial goals in the Forex market.