Simplifying the ICT Silver: Complete Check List

The ICT Silver Bullet is a powerful time-based trading strategy that focuses on specific periods each day to create reliable trading setups.

This strategy is effective across major forex pairs (EURUSD, GBPUSD, XAUUSD) and indices (E-mini S&P, NASDAQ 100, US30).The primary objective is to achieve at least 40 ticks or 10 points in indices and 15 pips in forex pairs, maximizing trading opportunities.

How ICT Silver Bullet Trading Strategy Works?

The core focus of this trading strategy is to identify the next Drawn On Liquidity (DOL). By pinpointing key pricing areas where liquidity is likely to be targeted, traders can anticipate significant price movements. The critical areas for identifying DOL include:

- Previous Day Low and High

- Previous Session Low and High

- Previous Week Low and High

- Return to Current or Old New Week Opening Gap

- Expansion Away from Current or Old New Week Opening Gap

- ICT Classical Optimal Trade Entry

By focusing on these key levels, traders can better understand market dynamics and improve their chances of entering trades at optimal points.

ICT Silver Bullet Time

The key time of focus in this strategy is

| Session Name | Key Time To Observer |

| London Open | 3 am to 4 am |

| New York AM Session | 10 am to 11 am |

| New York PM Session | 2 pm to 3 pm |

Note observe all time with respect to New York Local time in Summer UTC-4 and in Winter UTC-5.

What is Best Time Frame For ICT Silver Bullet Trading Strategy?

To effectively trade this strategy, you’ll need to analyze multiple time frames to identify directional bias, confirm setups, and execute trades.

- Identify Directional Bias (1-Hour Time Frame)

- Start with the 1-hour time frame as your daily chart. This will help you determine the overall directional bias of the market. By analyzing price action and key levels on this time frame, you can understand the broader trend and prepare for potential trade setups.

- Confirm Setups (15-Minute to 5-Minute Time Frame)

- Once you’ve established the directional bias on the 1-hour chart, move to the 15-minute or 5-minute time frame to confirm potential trade setups. Look for price patterns, like Bullish and Bearish Order Blocks, Breaker Blocks and Fair Value Gaps that align with the bias identified on the 1-hour chart.

- Execute Trades (1-Minute to 5-Minute Time Frame)

- For precise entries and exits, use the 1-minute to 5-minute time frames. Focus on fair value gaps and the PD (Premium-Discount) array matrix to find optimal entry and exit points. These shorter time frames allow for more accurate timing, enabling you to capitalize on small price movements while minimizing risk.

By integrating these time frames and techniques, you can enhance your trading precision and maximize the effectiveness of the ICT Silver Bullet strategy.

ICT Silver Bullet Example

Look at an example of the ICT Silver Bullet strategy applied to the EURUSD pair:

- Liquidity Sweep:

- On the 5-minute chart, the price sweeps the liquidity of the previous day’s high. This is a crucial step as it indicates that the market has cleared out the stop orders above the previous high, potentially signaling a reversal.

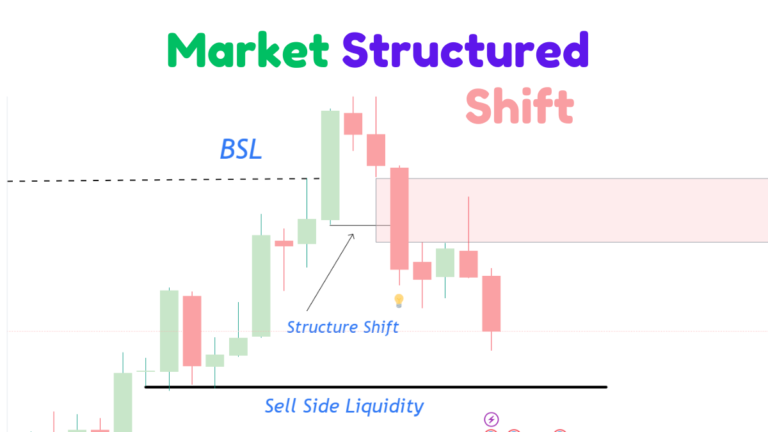

- Market Structure Shift:

- After the liquidity sweep, observe for a market structure shift. This shift occurs when the price action breaks the previous low, indicating a potential change in direction.

- Inverted Fair Value Gap:

- Following the market structure shift, look for an inverted Fair Value Gap (FVG). This gap is a key signal for entering the trade, as it represents an imbalance in price action that the market is likely to correct.

- Targeting the Next PDA Array Matrix:

- In this example, our target is the next PDA (Premium-Discount Array) matrix, which in this case is a bullish order block. The bullish order block represents a strong support level where the price is likely to reverse or consolidate.

By following these steps, you can effectively implement the ICT Silver Bullet strategy to capture profitable trades in the market.

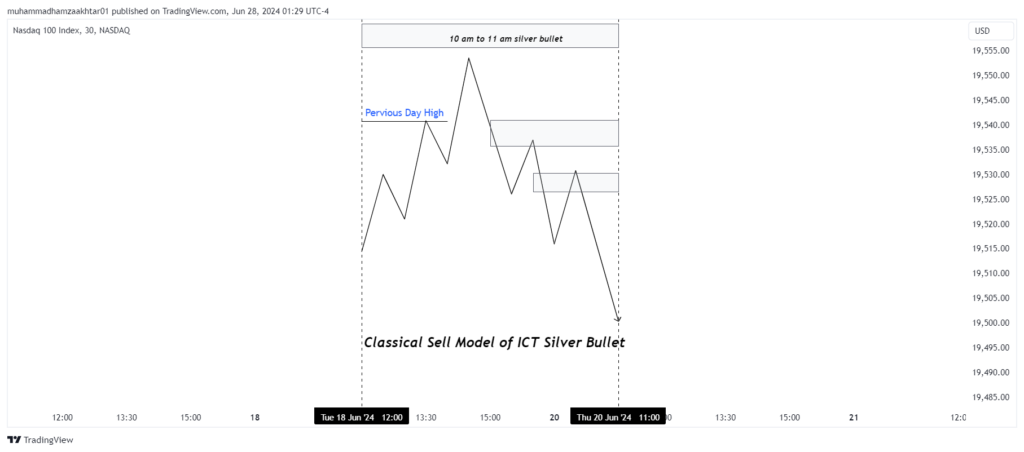

Classical Sell Model of Silver Bullet Strategy

What is win rate for this Trading Strategy?

The average win rate for Michelle J. Hudleston’s Silver Bullet Strategy is between 78% and 90%. To increase your success, you can trade during the New York AM session (NY Open) from 10 AM to 11 AM local New York time.

What Time Is Best For Trading Michael J. Huddleston Silver Bullet Strategy?

The best time for trading Michael J. Huddleston’s Silver Bullet Strategy is during the New York AM session, specifically from 10 AM to 11 AM local New York time. This period is known for increased market activity, which can enhance the effectiveness of the strategy.

Helping Traders Scale to $10k/month in EUR/USD, GBP/USD, and E-mini S&P

With over 7 years of Forex market experience, Osama Asif is an expert in technical and fundamental analysis. Since 2024, he has been a key contributor to the ICT Trading platform. As a Certified Financial Risk Manager (FRM), Osama is passionate about precision and dedicated to guiding traders to achieve their financial goals in the Forex market.