ICT Turtle Soup Strategy A False Breakout Approach

The ICT Turtle Soup trading strategy is a sophisticated approach used in the forex market to exploit false breakout scenarios orchestrated by market makers, commonly referred to as “smart money”.

What is the ICT Turtle Soup Pattern?

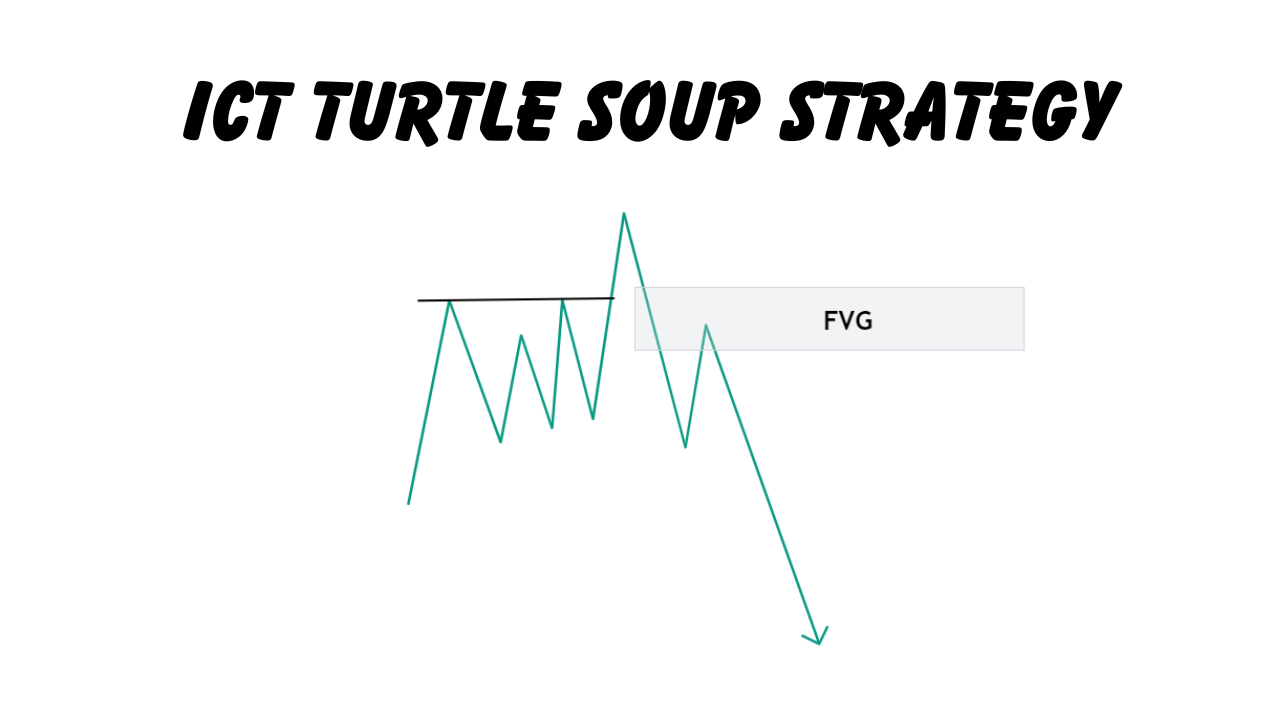

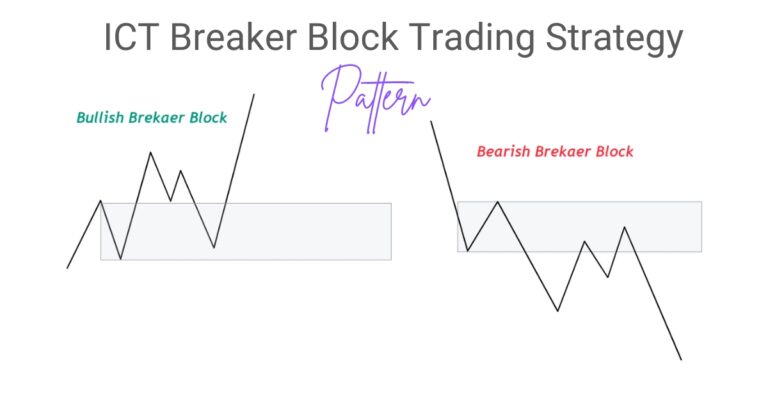

The Turtle Soup pattern, developed by the Inner Circle Trader (ICT), is designed to capitalize on deceptive breakouts where the market appears to break out of a significant support or resistance level but quickly reverses direction.

How Does It Work?

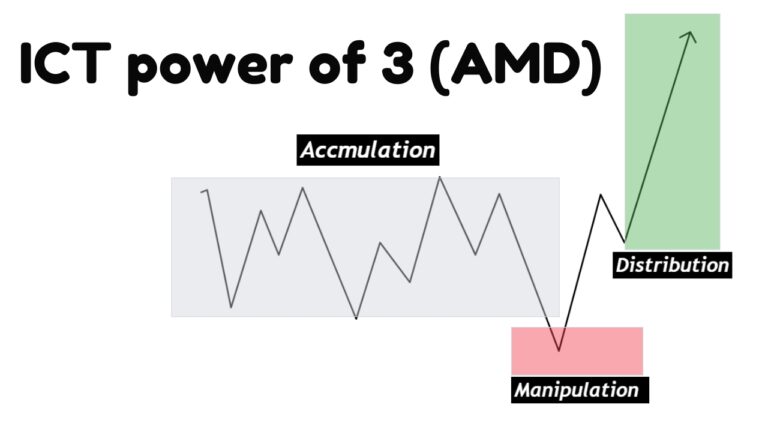

The strategy is particularly effective in choppy, ranging markets where price oscillates between established highs and lows. The pattern relies on the assumption that breakouts in such conditions are often traps set by institutional players to trigger retail traders into entering positions in the direction of the breakout, only for the price to reverse.

Key Elements of this Strategy:

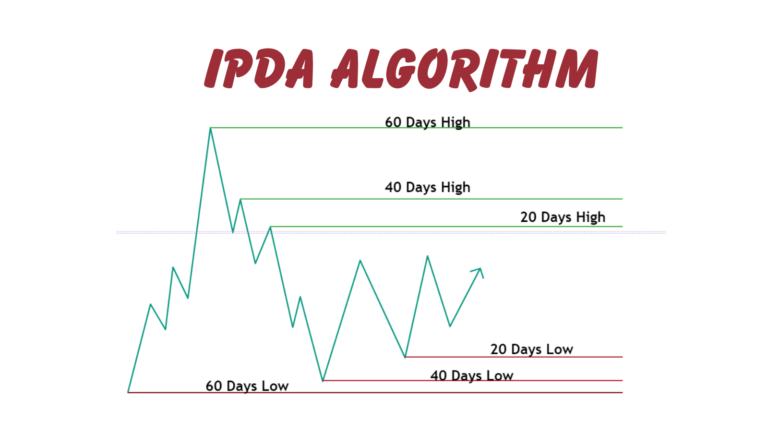

Higher Time Frame Analysis: Higher time frame daily and 4 hourly help to established the bias. From where is price come and where its goes.

Find Liquidity: Find old highs and old lows on chart. These are the point where liquidity rest in the form of stop loss.

Find IRL: Find the internal range liquidity. The IRL are find on moving short term time frame like m15 to find the next drawn on liquidity.

How to Trade Turtle Soup Pattern

- Step 1: Assess the order flow and liquidity levels on a higher timeframe to gauge overall market direction.

- Step 2: Move to a lower timeframe and identify recent liquidity levels within the internal range that contradict the higher timeframe’s order flow.

- Step 3: Monitor the price as it breaks these internal range levels (the setup for the trap). When the price reverts back into the range (signaling the trap was sprung), it’s an indication to prepare for a trade.

- Step 4: Execute the trade in the direction of the higher timeframe order flow once the price re-enters the range.

This strategy can be used across various trading styles, including intraday trading, scalping, and swing trading. For better effectiveness, it’s often combined with other ICT strategies, like ICT PD Arrays.

Success Rate and Considerations:

While no trading strategy guarantees 100% success, the Turtle Soup pattern has shown high efficacy when applied correctly, potentially reaching an 80% success rate. However, like all trading strategies, it’s vital to manage risk carefully. Using stop-loss orders and not overleveraging are prudent practices to safeguard your capital.

Why does ICT call it Turtle Soup?

ICT named the strategy “Turtle Soup” because it focuses on identifying and capitalizing on false breakouts, similar to the way the original “Turtles” trading group looked for real breakouts.

The “soup” part of the name comes into play as it humorously suggests that this strategy is about “cooking” or making the most out of the situations where the Turtles’ typical breakout strategy fails.

So, just as making soup from turtles is about turning them into something useful (in a culinary sense), the Turtle Soup trading pattern is about turning failed breakout situations into profitable opportunities.

Final Thoughts:

The ICT Turtle Soup pattern offers a strategic way to approach forex trading, particularly in markets prone to manipulation and false signals. As with any trading approach, thorough back-testing and practice are recommended to understand fully and effectively implement the strategy under various market conditions.

iCT turtle soup pdf

Download turtle soup ICT Trading Strategy By Clicking on the Below Download Button.

Helping Traders Scale to $10k/month in EUR/USD, GBP/USD, and E-mini S&P

With over 7 years of Forex market experience, Osama Asif is an expert in technical and fundamental analysis. Since 2024, he has been a key contributor to the ICT Trading platform. As a Certified Financial Risk Manager (FRM), Osama is passionate about precision and dedicated to guiding traders to achieve their financial goals in the Forex market.