ICT London Killzone 15 minute Trading Strategy

In the world of forex trading, timing is crucial. One strategy that has been gaining popularity among traders is the London Killzone. This 15-minute window during the London trading session could be your golden opportunity to enhance your trading strategy.

What is the London Killzone?

The London Killzone refers to a specific time frame in the London trading session known for its high liquidity and volatility. This period provides excellent opportunities for traders to make profitable trades due to the intense market activity.

Key Points:

- Timing: Focus on the initial hours of the London session

- Markets: Primarily impacts Euro, Pound, Franc, and Gold

- Liquidity: High number of market participants leads to significant price movements

Why is the London Killzone Important?

- Liquidity Injection: London traders entering the market bring fresh capital and new perspectives, which can lead to trend changes or continuations.

- Price Action: Many daily highs and lows are established during this time, offering clear entry and exit points.

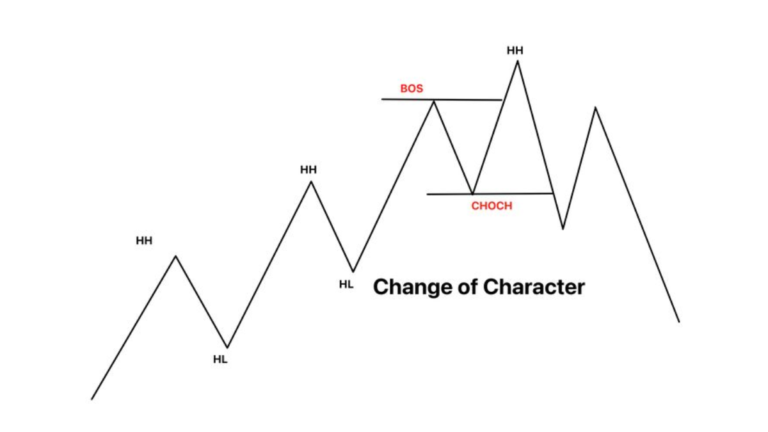

- Market Structure Changes: The transition from the Asian session to the European session can cause notable changes in market structure.

Setting Up Your Charts

Proper chart setup is essential for trading the London Killzone effectively:

- Use TradingView or your preferred trading platform.

- Add the WR Market Sessions indicator to highlight the London session.

- Focus on the 15-minute timeframe, but also consider analyzing higher timeframes for context.

Trading Strategies for the London Killzone

The chart above illustrates the London Killzone trading strategy. To implement this strategy, follow these steps:

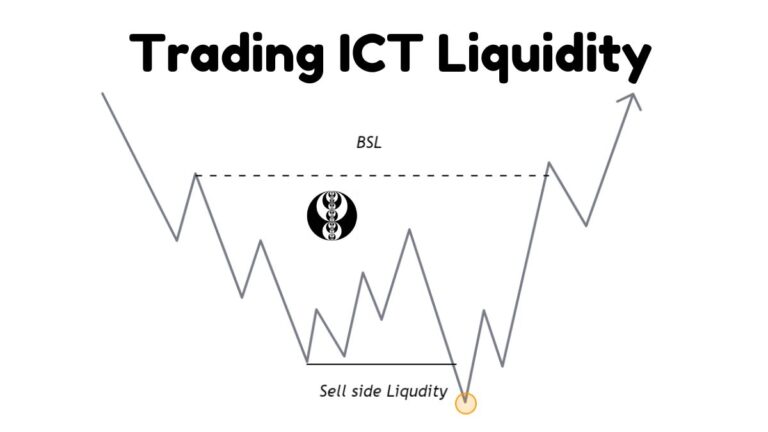

- 15-Minute Time Frame: Wait for a liquidity sweep below the Asian low if you’re anticipating a bullish move, or above the Asian high if larger time frame analysis suggests a bearish trend.

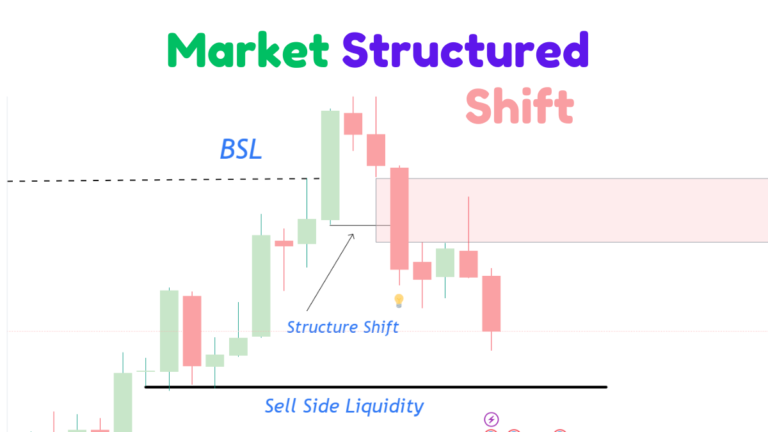

- Lower Time Frames: Shift to 5-minute, 3-minute, and 1-minute charts to identify a Market Structure Shift (MSS) that leaves a Fair Value Gap (FVG).

- Execute Trades: Once you spot the gap on the lower time frames and it begins to fill, execute your trades accordingly.

Common Scenarios in the London Killzone

- Liquidity Sweep and Reverse: Price moves beyond daily extremes before reversing.

- Trend Continuation: The existing higher timeframe trend continues, providing entry points for momentum traders.

- Complete Reversal: A major shift in market direction, presenting opportunities for contrarian traders.

Tips for Success

- Combine your 15-minute analysis with insights from higher timeframes.

- Be patient and wait for clear trading setups; not every day will present ideal conditions.

- Practice proper risk management, as the volatility in the Killzone can cause rapid price movements.

Conclusion

The London Killzone strategy offers a structured way to take advantage of one of the most active periods in the forex market. By understanding the market dynamics, setting up your charts effectively, and waiting for high-probability setups, you could improve your trading outcomes.

Keep in mind, no strategy is perfect, and continuous learning and adaptation are essential for long-term trading success. Happy trading!